Finance has consistently been a high-risk, high-reward industry. Due to this, companies are looking for new and effective methods to boost returns and reduce risk. To tackle this challenge, artificial intelligence (AI) and machine learning (ML) in fintech have emerged as a blessing, as it helps them in so many different ways.

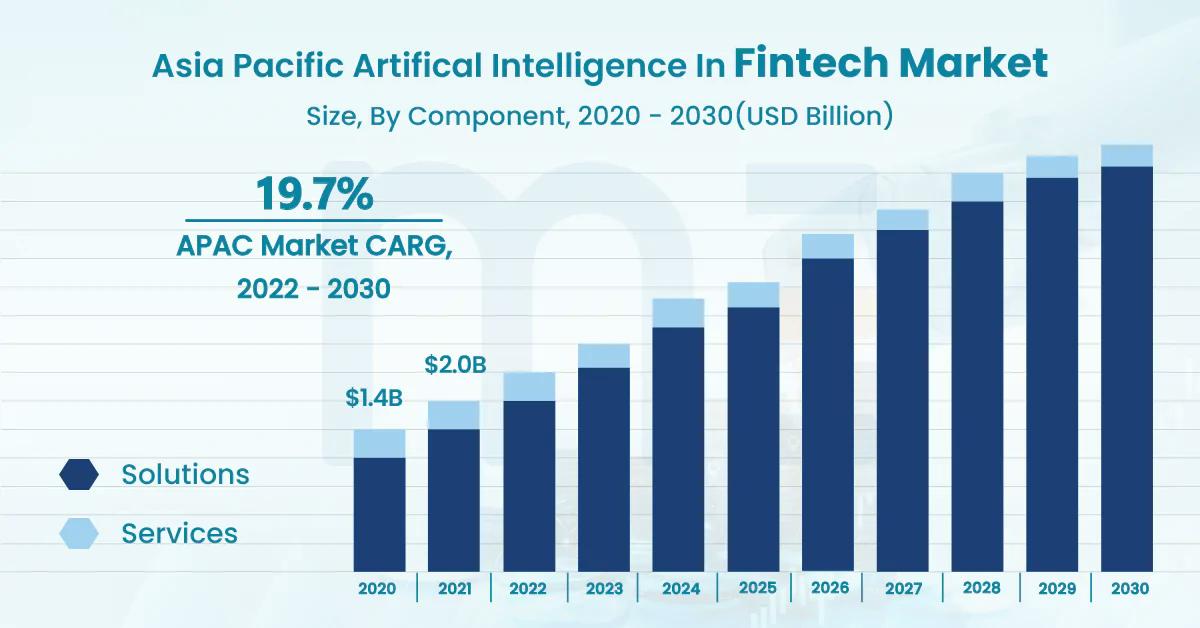

According to Global Industry Insights, the BFSI industry would increase at a 20% compound annual rate from 2023 to 2032, reaching USD 20 billion in 2022. This expansion might be attributed to the BFSI industry's growing tendency to invest in AI and ML products and services.

The use of machine learning in the fintech sector has a significant impact and is completely changing how financial institutions operate, make decisions, and interact with their customers.

Source: Mtraction Enterprise

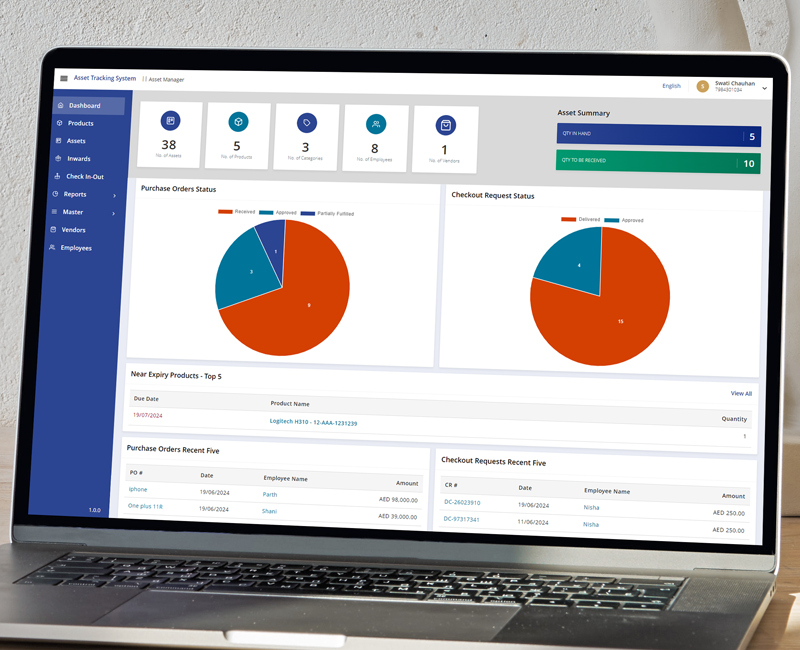

Machine learning algorithms are capable of quickly processing huge amounts of crucial financial data, and funding patterns, and offering insightful results. Financial organizations can leverage all this structured data to get accurate predictions, and risk assessments, and make data-driven choices.

If you are willing to know more about how AI and ML are revolutionizing Fintech app development and the finance industry as a whole, then this blog has got you covered.

Let’s dig down!

What is Machine Learning In Fintech?

Machine learning is a subset of artificial intelligence that helps companies learn and improve based on customer experiences without the need for explicit programming. It involves the use of algorithms to evaluate customer data, market trends, and future predictions and make decisions considering all the collected data.

Machine learning has proven to be beneficial not only in the finance industry but in every industry as a whole, as it enables automation, data-driven insights, and the development of intelligent systems.

Nowadays, machine learning in fintech is one of the most crucial components as it has so many benefits and use cases in this industry, such as asset management, risk assessment, credit scoring, loan approval, etc.

Some of the Popular Use-Cases & Benefits of Machine Learning For Fintech!

Helpful in determining the accurate credit score!

Some of the most important benefits of machine learning and artificial intelligence in fintech are predictive analytics and decision-making abilities.

Particularly, financial institutions and other fintech companies can use machine learning and artificial intelligence in fintech to better manage credit scoring and the flow of funds by granting loans that are governed by machine learning-based systems for assessing credit rather than conventional rule-based systems.

Machine learning-based scoring methods function with more complex characteristics and settings, resulting in dependable and accurate credit score readings for individuals, as opposed to rule-based scoring systems, which operate based on data about age, gender, occupation, and other generic information.

By taking into account all of this data, banking institutions by partnering with leading AI development company for development or integration can make more individualized decisions about a person or company, which will result in fewer bad debts and higher returns.

Risk Management & Fraud Detection

For every finance business out there, identity theft, credit risk, fraud risk, and underwriting risk are their worst fears. Crowe estimates that the global economy costs the financial sector $5 trillion annually, and that figure is only going up. Systems used in the past to detect fraud were not very effective. ML entered the picture at that point. With the help of advanced analytics and predictive analytics, ML-enabled finance software can identify these risks.

Machine Learning algorithms will detect irregularities in purchasing behavior and restrict the card before further harm is done. The ML-integrated modern fraud detection system keeps track of past fraud trends and modifies itself to avoid them in the future. ML-integrated software streamlines data analysis and assists fraud analysts in providing more accurate results.

Portfolio Management

Machine learning can even help clients manage their portfolios by providing automated financial advice to them. Among the popular use cases of ML in fintech is using algorithms to create a financial portfolio in accordance with the objectives and risk tolerance of an investor.

Investors must enter their savings or investment objectives into ML-enabled fintech app development, and the system will then automatically identify the best investment possibilities with the highest returns.

For example, a 30-year-old investor with a $500,000 savings goal by the time they retire can enter those objectives into the application. To accomplish the objectives, the app then distributes the investments across various financial assets, including stocks, bonds, real estate, etc. Even better, the program optimizes the investor's objectives in light of current market trends.

Better and streamlined debt management

The conventional debt-collecting method was difficult, inefficient, and disorganized. The management and collection of debts have benefited a lot from AI and ML in the fintech industry. These procedures are now efficient because of sophisticated AI/Ml in fintech software, which also helps to maintain and improve positive customer relationships.

Businesses are employing Ml and AI in fintech software to collect data, which improves payback rates using statistics and analytics.

Even better, it helps identify the application of behavioral science to the development of customized debt collection strategies for various consumers, resulting in increased personalization and client happiness.

Fintech firms can use these out-of-the-box technologies for various payment automation methods and improved A/B testing when implementing AI in fintech.

Personalized Banking services for customers

Machine learning has revolutionized the way personalized banking experiences are delivered to customers. By leveraging sophisticated ML algorithms and data analytics, fintech companies can better personalize their solutions to meet the specific requirements of their individual customers.

It helps fintech companies in evaluating customer's transaction history, spending patterns, investment choices, and even their bank interactions. By using all these data, companies can generate crucial insights that drive highly personalized recommendations and services for their customers.

These recommendations could range from suggesting suitable investment options based on risk tolerance to providing tailored loan offers with favorable terms. This level of personalization enhances customer engagement, fosters loyalty, and ultimately leads to a more satisfying and efficient banking experience.

Algorithmic Trading

Algorithmic trading is the practice of using mathematical formulas to improve trade decisions. To identify any factors that can cause the price of an asset to rise or fall, traders typically construct statistical models that track business news and trading activity in real time.

The model comes with an established set of guidelines on numerous criteria - including timing, price, amount, and other factors - for placing trades without the trader's active engagement.

Algorithmic trading has the capacity to evaluate vast amounts of data and execute tens of thousands of trades daily, in contrast to human traders. Human traders have an advantage over the market average thanks to machine learning's quick trading judgments.

Also, algorithmic trading does not rely on emotion-driven decisions, the trading is solely based on data collected, analyzed, and current market trends - leading to better decisions and returns as well.

Helps with underwriting services!

Underwriting services in the banking and insurance industries rely significantly on staff to assess historical data and draw judgments. Another difficulty was trying to decrease risks and give customers value while using unstructured systems and procedures.

This antiquated, manual procedure is prone to mistakes and inefficiency. However, by using Machine Learning algorithms that collect and make sense of massive volumes of data, process automation simplifies the underwriting process. In addition, it improves rule speed, manages straight-through acceptance (STA) rates, and prevents application errors.

Since the majority of the procedure has been automated, underwriters can concentrate primarily on complex cases that may require manual attention. This helps businesses save time, money, effort, and other vital resources.

To conclude

To sum it all up, the popularity of machine learning is increasing in all industries, and the finance industry is no exception. It is drastically transforming the financial industry, providing several benefits such as increased efficiency, greater risk management, and improved consumer experiences.

We hope that this blog has done a good job of highlighting the critical use cases and benefits of machine learning in the fintech business.

But as more and more businesses adopt ML and AI in fintech, it is essential to follow ethical practices to harness the benefits of these cutting-edge technologies.

By adopting moral AI principles, the financial sector may fully utilize machine learning while retaining its commitment to moral decision-making and client satisfaction. If you are willing to develop a custom ML-driven fintech app or just want to integrate this technology into your current app - Sufalam Technologies can help you out.

We have a skilled team with comprehensive know-how of technological capabilities, customization, and security focus to help clients build custom financial software solutions or integrations that meet their specific needs and drive digital transformation in the financial sector.

Frequently Asked Questions

What are some of the common challenges that businesses face when it comes to adopting ML in fintech?

Here are some of the common challenges of adopting Machine learning in fintech:

Data Privacy and Security Concerns

Complex learning algorithms

Lack of transparency in their decision-making process

Challenges with Regulatory Compliance

Data Quality and Bias leading to discriminatory outcomes

Unreliable predictions and inaccurate risk assessments

What is the future of AI and ML in fintech?

The future of AI and ML in fintech surely shines bright as it will further result in hyper-personalization, efficient risk assessment, fraud detection, and streamlined customer interactions, leading to better customer experience and enhanced operational landscape of the financial industry.

Is it important to hire a machine learning development company?

It is not important to hire a machine learning development company. But when you hire a professional to handle your machine learning development solutions, you can witness better and more customer-friendly solutions.