Payment gateways in Saudi Arabia have been instrumental in revolutionizing the eCommerce business landscape. With the rapid advancement of technology and the increasing demand for convenient and secure online transactions, payment gateways have played a pivotal role in driving the growth of the digital economy in the KSA.

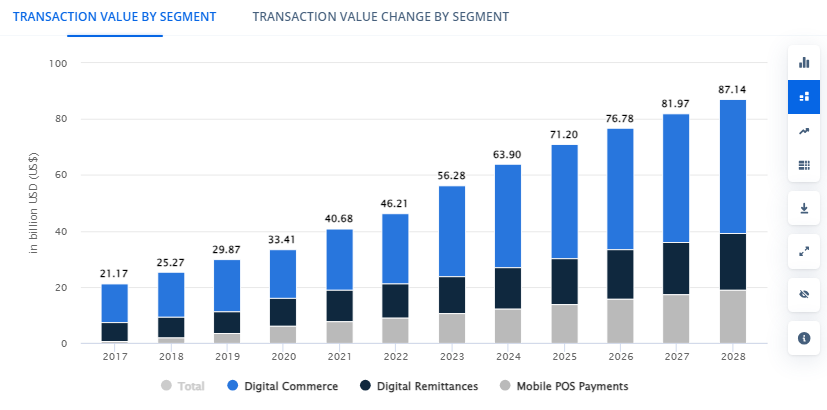

According to recent studies, The total transaction value in the Saudi Arabia digital payments market is projected to reach US$63.9 billion in 2024, and US$87.14 billion by 2028. A well-integrated online payment gateway in the app streamlines the checkout process and ensures that customer transactions are secure, quick, and convenient.

Source: statista

In this blog, we highlighted the top payment gateways in Saudi Arabia that have a big impact on the eCommerce industry and discussed the advantages of working with a mobile app development company to hire a payment gateway developer. Let’s delve in.

An Overview of Payment Gateways in Saudi Arabia:

Saudi Arabia sits at the heart of one of the Middle East's most influential economies. Thanks to its affluent and tech-savvy population, the nation's online sector is experiencing unprecedented growth. Businesses have transformed e-commerce and financial transactions by integrating payment gateway APIs and choosing fintech app development services from one of the best mobile app development companies in Saudi Arabia.

These gateways serve as the bridge between customers and merchants, ensuring that payments are processed efficiently and securely. As Consumers are increasingly turning to online channels for their shopping needs, this changing consumer behavior is driving widespread acceptance and reliance on online payments, shaping the landscape of e-commerce in Saudi Arabia and beyond.

The Significance Impact of Payment Gateways on eCommerce Business in Saudi Arabia

The significance of payment gateways in Saudi Arabia's eCommerce landscape cannot be overstated. Their impact extends beyond mere transaction processing, they enhance customer satisfaction and drive revenue growth.

Top Notch Security:

Payment gateways provide robust encryption and security measures, ensuring the safe transfer of sensitive financial information during online transactions. To achieve seamless and secure payment gateway API integration in your app, hire payment gateway developers from the renowned mobile app development company in Saudi Arabia.

Improved Customer Experience:

Payment Gateway offers multiple payment options, allowing customers to choose their preferred method of payment, such as credit/debit cards, digital wallets, or bank transfers. Businesses are free to customize payment gateway solutions to meet their specific needs, which guarantees a user-friendly checkout process and customer satisfaction.

Worldwide Outreach

Payment gateways enable businesses in Saudi Arabia to accept payments from customers worldwide, expanding their market reach and potential customer base. By partnering with a fintech app development company, businesses can get scalable and globally compatible payment gateway solutions in Saudi Arabia.

Faster & Quicker Payment Transactions:

Integrating payment gateway in eCommerce development streamlines the transaction process, reducing checkout times and minimizing the risk of abandoned carts, thereby increasing conversion rates. The eCommerce industry should consider the best payment gateways in Saudi Arabia to enhance the overall payment transaction experience.

A Guide to Choosing the Best Payment Gateway in Saudi Arabia

When discussing payment gateways, one of the most popular questions is how to choose the finest online payment gateway for your clients and store. Making the right decision for an online payment gateway in Saudi Arabia will save you money, time, and clients.

To build a strong integrated app for your online business, you should hire dedicated app developers from the best mobile app development company in Saudi Arabia and consider the following aspects to make an informed choice.

Uncompromised Security:

When processing payments, security comes first. A payment gateway in Saudi Arabia should adhere to industry-standard security features and protocols, like PCI DSS (Payment Card Industry Data Security Standard). To protect your customers’ data and your business reputation, data security is top in the section during selecting the best payment gateway.

Transaction Fee Structure:

The best deal might not necessarily be the best deal on the surface, so you should consider all possible costs before committing to anything. In the end, you will want to choose a payment gateway provider that is transparent about their requirements and flexible about their service terms.

In most cases, payment gateways come with three fees: setup, monthly, and transaction fees. Additionally, there are registration fees, processing fees, refund fees, transfer fees, batch fees, and limit fees. Merchant Discount Rates (MDRs) are another important one to keep in mind since they take a small percentage of each value processed on your behalf.

Also Read: Profitable Business Ideas in Saudi Arabia!

Plugin Type & Multi-currency Support:

Some payment gateway providers offer plugins for e-commerce platforms and alternative payment methods (APMs), such as Apple Pay and Google Pay. When selecting a payment gateway in Saudi Arabia, ensure that it supports a wide range of currencies and provides seamless integration options that are compatible with your company's technical requirements and preferences.

Payment Processing Timing

If you want to integrate a payment gateway in Saudi Arabia, keep in mind that instant payment approval is not enough to list yours in the best payment gateways. After approval, it is important to take into account how long it will take for the funds to settle into your merchant bank account. Depending on the online payments provider, this holding period may be as short as 24 hours or up to a week in extreme cases.

Limitation on Transactions

There may be a monthly restriction on the number of transactions you may process with some payment gateways. Small businesses may not have a problem with this. However, if your firm conducts a large number of transactions or is selling high-value products, you must be aware of any such limits or restrictions to prevent customers from switching.

Compatible with All Devices

Choose a payment gateway in Saudi Arabia that is compatible with all devices to ensure a seamless payment experience across desktops, laptops, tablets, and smartphones. This compatibility guarantees to improved overall user experience and increases successful transactions.

The Top 3 Best Payment Gateways in Saudi Arabia

One of the most important aspects of starting an online business is deciding on the best payment gateway to integrate Saudi payment methods. The following listed are the best payment gateways in Saudi Arabia. To choose the best, let’s take a look at the most well-liked one.

PayTabs

When it comes to selecting the best payment gateway in Saudi Arabia, PayTab has been an exceptional inspiration. In the thriving digital economy, PayTab is adopted widely by all sizes of businesses sizes. With support for multiple payment methods, including credit/debit cards and e-wallets, PayTabs ensures convenience and flexibility for both merchants and consumers.

- User-friendly interface & seamless integration.

- Robust security measures.

- Streamline revenue management for businesses.

- Multiple-payment Acceptable.

- Advanced fraud prevention tools.

- PCI DSS compliance.

HyperPay

HyperPay is another best payment gateway in Saudi Arabia that stands out for its rapid payment processing capabilities. With swift integration with various e-commerce platforms and customizable checkout options, HyperPay ensures a seamless payment experience for merchants and customers.

- Recurring billing and reporting

- Highly suitable for all major e-commerce platforms like Shopify, WooCommerce, Cabiri, etc.

- Dedicated account manager for one-on-one support.

- A smooth payment process for both customers and merchants.

PayPal

PayPal is a globally recognized digital payment platform that has established itself as a leading choice for individuals and businesses alike. With its widespread acceptance and reputation for reliability, PayPal continues to be a preferred payment gateway solution in Australia and for millions worldwide.

- Operates in over 200 countries/regions.

- Supports transactions in more than 100 currencies.

- Cutting-edge encryption technology.

- Prevent unauthorized transactions.

- Versatile payment options

A Final Thought:

In conclusion, the evolution of payment gateways in Saudi Arabia is significantly impacting the e-commerce business landscape. With advancements in technology, the introduction of secure and efficient payment gateways has facilitated seamless transaction processing around the globe.

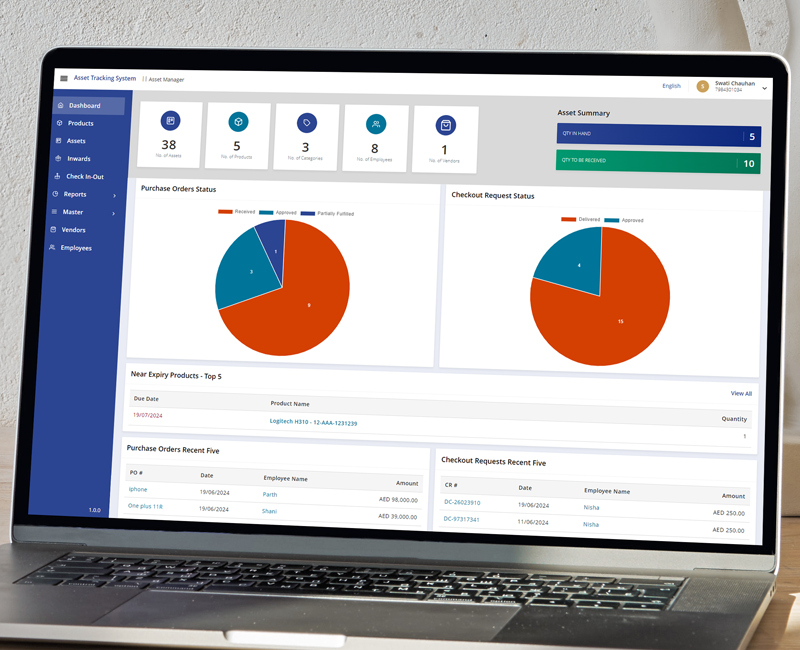

For the best payment gateway solution in Saudi Arabia, reach out to Sufalam Technologies. Sufalam Technologies is a leading fintech app development company in Saudi Arabia, providing valuable insights and payment gateway solutions that are tailored to your unique business needs. Hire payment gateway developers right away and uplift your ecommerce business!

Frequently Asked Questions

Which payment methods are supported by payment gateways in Saudi Arabia?

Payment gateways in Saudi Arabia typically support local methods like Mada, Sadad, and major international credit/debit cards.

What additional features does the payment gateway offer?

Some payment gateways provide features like recurring billing, currency/card support, and analytics tools to enhance business operations.

Can you help me set up and troubleshoot my payment gateway?

Yes, We provide end-to-end payment gateway solutions offering responsive customer support to assist with setup, integration, and resolving any issues that may arise.