Having a trustworthy and effective payment gateway is essential for businesses in the modern digital age. Businesses can securely and effectively take online payments thanks to payment gateway technology. With so many payment gateways in Qatar market, picking the best one for your business will mean all the difference in the world.

When it comes to the software sector, Qatar is booming. Due to Qatar's high level of digital literacy, cash transactions are at an all-time low, yet payment gateways are nonetheless entering the market.

To help you choose the best payment gateway for your business, this article seeks to give a general overview of the Top Payment Gateways you should choose for your business in Qatar, their features, and other things around it. Continue reading to learn about the best payment gateway in Qatar and other things from the best eCommerce development company. Let’s get started.

What is Qatar Payment Service?

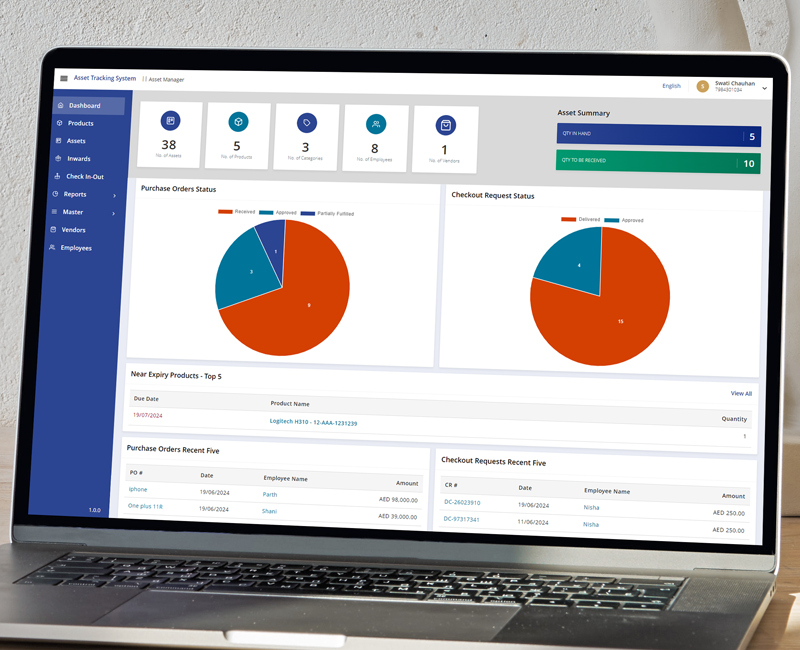

The Qatar Central Bank (QCB) offers a secure online payment gateways in qatar service known as Qatar Payment Gateway to support e-commerce in Qatar. It enables companies to accept credit and debit card payments online and accepts well-known card brands including Visa, Mastercard, and American Express.

With encryption and fraud detection tools in place to protect the security of transactions, the Payment Gateway in Qatar offers a dependable and secure platform for online transactions. Additionally, it provides functions like recurring payments, reimbursements, and real-time transaction tracking and analysis.

Companies can apply for the Qatar Payment Gateway service via their purchasing banks or payment service providers. To be eligible for the service, businesses must meet certain criteria and adhere to QCB rules.

Which things to consider before choosing an online payment gateway in Qatar?

Payment gateways pave the way by making it easier for buyers and sellers to exchange money. However, as a business, if you want to use a payment gateway, you need to search for a few things before committing.

Before choosing a payment gateway, keep the following things in mind:

1. Reliability

If you frequently deal with financial and monetary standards, you should take into account a dependable online payment gateway in Qatar with a respectable market reputation. In this way, whenever you or your clients conduct business with your company online, you can be sure it is secure and that you won't be deceived.

2. Support currencies

As you grow your company internationally, you need to accept payments in many currencies. However, not every payment gateway offers various currencies, which is frequently a deal breaker. The local populace can receive/send payments via their preferred method thanks to the wide range of local and foreign currency alternatives offered by each country's payment gateway.

RELATED: How Much Does It Cost to Build a Flight Booking App?

3. Transaction Fees and Pricing Structure

Analyze the cost structure of each online payment gateway in Qatar. Pay attention to not just the transaction fees but also other potential charges, such as setup fees or monthly subscription fees. In Qatar's competitive market, balancing cost-effectiveness with service quality is crucial. Consider how transaction fees may impact your profit margins, especially if you anticipate a high volume of transactions.

4. Security and Compliance

Qatar, like many countries, has stringent security regulations. Prioritize a payment gateway that is PCI DSS compliant and follows best practices for data security. Robust encryption, tokenization, and fraud detection mechanisms are essential to protect your customers' financial information and maintain their trust.

5. Customer Support and Responsiveness

Exceptional customer support is indispensable when dealing with payment-related issues. Choose the best payment gateway in Qatar with responsive customer support, preferably available 24/7. Fast resolution of technical problems or payment disputes can prevent revenue loss and maintain customer loyalty.

RELATED: How Much Does Mobile App Development Cost in Qatar?

6. Local Regulations and Currency Support

Stay informed about Qatar's specific regulations related to payment processing, including currency exchange and cross-border transactions. Select a payment gateway that not only complies with these regulations but also offers multi-currency support if your business deals with international customers. It will help you provide a seamless and transparent payment experience for all users.

Quick-Tip: Apart from these key considerations, the comprehensive integration of the payment gateway platform with your eCommerce is quite crucial. So, make sure you hire dedicated developers with the required expertise and skills for a smooth integration process.

Top 5 Payment Gateways In Qatar Must Be Aware of!

1. Myfatoorah

Myfatoorah accepts the majority of payment options, including e-wallets and nearly 20 different credit and debit cards, all of which may be simply linked to your website.

Additionally, it accepts nearly all GCC currencies. In addition to customizable features like payment links and online storefronts to make things even simpler for you, the plugin enables you to receive a thorough report for each sale you close. MyFatoorah offers both outstanding fraud protection and safe payment processing.

When choosing Myfatoorah, the consumer's convenience is crucial. For KNET payments, there is a 2% transaction fee, and payments made with a credit card have a 3.5% fee. No matter the size of your business, it also enables the planning of fixed installments and MF invoicing.

2. Sadad

Sadad includes practically all of the features you're looking for in a payment gateway. Simple payment connections enable quick and safe purchases without even requiring an online presence! The plugin is simple to set up and integrate into your company's operations.

To improve the success rates of purchases, they also feature bilingual and configurable payment pages. From invoicing to cancellation, Sadad can keep track of your customers' financial behavior on your platform.

The transaction fee is 2.5%, or 2.5 QR and 2QR for each refund. Sadad uses a freemium business model, so you can still use some of its features without having to pay!

3. Fatora

Fatora is the best payment gateway in Qatar which offers a comprehensive solution for businesses in Qatar seeking efficient payment processing and invoicing capabilities.

With this payment gateway, you not only gain access to payment links but also enjoy additional features such as invoice generation and point-of-sale functionality. Fatora facilitates a meaningful connection between businesses and merchants, simplifying the process of sending and receiving payments within the MENA region.

In terms of pricing, Fatora's setup fee varies depending on the specific needs of users, offering flexibility to accommodate various business requirements. This platform is also versatile in terms of accepted payment methods, supporting major credit and debit cards.

Fatora offers integration capabilities with prominent eCommerce platforms, including WooCommerce, Shopify, Magento, and Wix. This compatibility simplifies the setup process for businesses, enabling them to leverage Fatora's extensive payment and invoicing features within their existing digital infrastructure.

4. CCAvenue

For companies in the UAE, CCAvenue is a reliable and all-encompassing Payment Gateway Solution that provides a full range of functions. To maintain the security of transactions and client data, it offers secure payment processing, fraud prevention strategies, and PCI-DSS compliance.

To accommodate consumer preferences, CCAvenue accepts a variety of payment options, including credit cards, debit cards, and mobile wallets. It allows simple interaction with popular e-commerce platforms and offers businesses a wide range of customization choices.

CCAvenue is a leading Qatar payment gateway utilized by companies for Payment Methods due to its open pricing policy and dependable service.

5. Noquoody

Noqoody supports all payment methods, including splitting bills among numerous bank accounts as well as card, mobile, and wallet payments. With customizable payment pages for your consumers, it has enhanced fraud protection. Additionally, Noqoody uses tokenization, which turns your private information into distinctive tokens for automatic payments.

Another factor that this payment gateway makes sure to consider is recurring payments. Your clients will immediately receive reminders for missed payments! Additionally, Noqoody accepts a variety of currencies for payments abroad. The transaction rates for each payment vary depending on the size of your business.

To Conclude

To sum it all up, here’s a complete wrap of the blog, where we have added everything you need to know about the basics of payment gateways for your business in Qatar, key considerations to choose the right one, and the top 5 best payment gateways in Qatar Business must be aware of!

And, as we are aware for businesses in Qatar, it's crucial to be aware of the top payment gateways in Qatar available. The region's unique economic landscape and cultural factors make it important to select the best online payment gateway in Qatar that aligns with your business goals and customer expectations.

From our blog, identify the scalability and key features of payment gateways and choose the right one as per your unique business requirements. By making an informed decision and staying attentive to your payment processing needs, you can create a reliable and convenient payment experience for your customers, ultimately contributing to the growth and success of your business.

If you are looking for professional guidance in choosing the right payment gateway provider or would need help with the integration, then Sufalam Technologies - the leading Mobile app development company, would love to help you out!

Frequently Asked Questions

Can I operate an online store in the UAE using several payment gateways?

It is possible to incorporate several payment channels to develop your eCommerce website. As a result, you can provide clients with a range of payment alternatives and accommodate their preferences. However, managing several payment channels could necessitate additional technical know-how and upkeep.

Is it possible to integrate a payment gateway with my current e-commerce platform?

You can integrate a payment gateway easily with your current platform, yes. Most payment gateways offer integration options for popular e-commerce systems such as Magento, WooCommerce, Shopify, and others. Make sure your selected e-commerce platform is compatible with the payment gateway you choose before making your choice.