Table of contents

- What Exactly is the Payment Gateway for E-commerce?

- E-commerce Payment Gateway Process!

- Different Types of Payment Gateways for E-commerce!

- The Top Payment Gateways You Should Know About!

- E-Commerce Payment Gateways Security Features for Online Transactions

- Factors to Consider While Choosing the Payment Gateway for Your E-commerce Business!

- How to Find the Best Payment Gateways for E-Commerce?

- Frequently Asked Questions

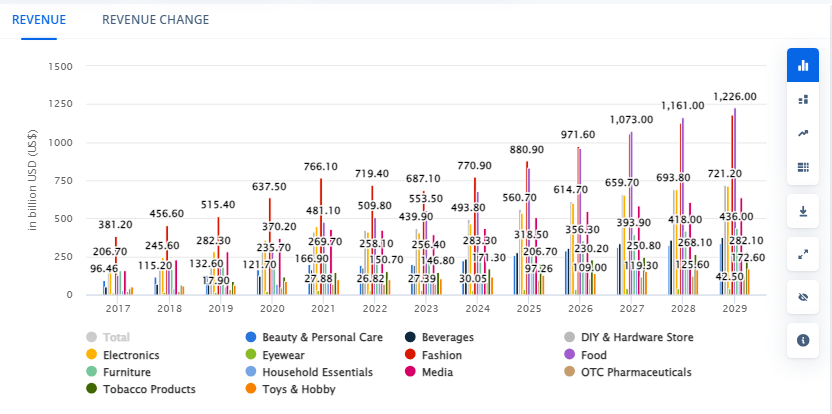

Did you know, that more than 2 billion individuals have made online purchase in 2023? It shows the growing extent and accessibility of e-commerce. However, as the market grows, so does the competition, and consumers are unlikely to trust every website that is out there. The secure online payment gateway and convenient payment alternatives might make all the difference.

Payment gateways are technology platforms that verify and handle financial transactions for online businesses.

They serve as a mediator between a company's website and the financial institutions engaged in the transaction. As global e-commerce sales are expected to exceed $3 trillion by 2023, dependable payment gateways for e-commerce development are going to continue to play a significant part in this industry, and choosing the best one for your company is quite important.

We'll go over the fundamentals of payment gateways, including how they function, the different types, and the best payment gateways. Our team of experts at our eCommerce development company also discusses how to choose a payment gateway that meets your company's and target market's specific demands.

So, let's get started.

What Exactly is the Payment Gateway for E-commerce?

An online payment gateway serves as a middleman between the e-commerce site and the buyer throughout the online transaction process. At the checkout point, the buyer enters their payment details, such as credit card, and debit card, among others into the payment gateway portal.

E-commerce payment gateways validate consumer payment information, ensure appropriate funds are available, and allow businesses to receive money.

They also include security precautions to prevent fraud - through encrypting sensitive data, such as credit card numbers, to ensure that information is safely transmitted between the customer, the business, and the payment processor.

The payment gateway you choose has a direct impact on your client's payment experience, level of data security, and payment method availability. And if establishing clients' trust is a long and difficult process, the correct payment gateway can make things much easier.

E-commerce Payment Gateway Process!

When you develop an e-commerce website, integrating a payment gateway becomes a crucial step. It ensures your customers can seamlessly pay for their purchases, turning website visitors into paying customers. Here's a breakdown of the eCommerce payment gateway process.

Online transactions are mediated via payment gateways.

- Data Collection: When a customer buys something and selects a payment method, they need to enter their payment details, e.g., credit card information, on the payment gateway page.

- Encryption: To protect the privacy of transaction details, the gateway encrypts the information gathered from the client's browser.

- Request for authorization: The online payment gateway then sends a transaction request to the payment processor affiliated with the company's acquiring bank.

- Processing: After receiving the request, the payment processor forwards it to the card network (Visa, Mastercard, etc.). The transaction is sent to the issuing bank(the bank that issued the customer's card) —by the card network in order to request transaction authorization.

- Authorization response: After receiving the request, the issuing bank checks to see if the transaction is legitimate and if the customer has enough credit or money. It then responds with an approval or denial to the payment processor.

- Status update for transactions: The processor sends the authorization response back to the payment gateway. The business can move forward with finishing the acquisition if it is approved.

- Settlement: Following authorization, the payment processor sends money from the issuing bank to the merchant account.

Different Types of Payment Gateways for E-commerce!

Choosing the right type of payment gateway for your eCommerce store is quite important. There are various types of Online payment gateway, depending on what merchants need and what customers are using. Let’s understand all the different payment gateways for E-commerce.

Hosted Gateways

These are offered by third-party providers. When a customer makes a payment, they are led to the payment service provider's platform, where the customer can enter their payment information and finish the transaction. Customers are directed back to the business's website once their payment has been processed.

These gateways are often simple to integrate and provide high security because the data is handled on the provider's servers. However, because the payment gateway process takes place off-site, businesses have less control over the client experience.

Self-hosted gateways

These gateways collect transaction data on the business's own website. Enterprises possess complete authority over the checkout procedure and client encounter.

Businesses that host this kind of gateway must also adhere to data protection regulations like the Payment Card Industry Data Security Standard (PCI DSS) and handle payment data securely. Companies who select this option usually desire a completely customized payment gateway process and are ready to handle the related security obligations.

API-hosted gateways

These provide a straightforward checkout process immediately on the company's website or app. Payment information is acquired using an application programming interface (API). This approach offers a seamless and integrated consumer experience, but in order to comply with data protection regulations, the company must maintain a secure environment for cardholder data.

The Top Payment Gateways You Should Know About!

Stripe

Stripe is the leading fintech company and one of the reliable payment processors. It supports both offline and e-commerce businesses. With Stripe Payments, you can accept international credit and debit cards as well as mobile wallets.

Over 120 countries and millions of businesses trust the Stripe online payment gateway. Among its clientele are some well-known companies including Amazon, Google, Microsoft, Shopify, Uber, Spotify, and Slack.

It offers a plethora of customization options so you may change the payment process as per your business requirements. Additionally, it permits companies to provide Buy Now Pay Later (BNPL) payment options.

Square

Square allows you to create your own online store with smooth payment processing and provides complete support for physical card reader terminals. This translates to quicker in-person sales as well as online sales assistance.

The user interface is simple to use and elegant. These include Google Pay, Apple Pay, Samsung Pay, and acceptance of payments for all major credit card brands online.

After you've created your account and added your products, you may include personalized buy buttons on your sales channels. To offer your clients the impression that shopping with you is safe, make sure to include those on your website.

Square provides an easy-to-use website builder with lovely themes that are quick to set up and publish.

Paytabs

Paytabs, an omnichannel payment solution provider, is expanding into Saudi Arabia. It provides a range of payment options to consultants, freelancers, enterprises, artists, micro-vendors, and entrepreneurs. These payment gateway integration services provide a dependable payment gateway solution along with secure payment processing and PCI DSS compliance. They take a number of payment methods, including bank transfers, digital wallets, and credit and debit cards. PayTabs offers streamlined, easy-to-use e-commerce platform plugins that offer a smooth integration with the most widely used systems. PayTabs has no upfront fees and a reasonable pricing structure.

Transactional commission:

- $49.99/month (for volumes under $2000)

- 2.85% + $0.27 for volumes above $2,000.

This one-of-a-kind payment gateway allows businesses to smoothly interface with popular eCommerce systems such as Magento, CS-Cart, Woocommerce, Shopify, Prestashop, OpenCart, and Expand Cart.

Also Read: 7 Profitable Business Ideas in Saudi Arabia!

SADAD

Saudi Arabian payment gateway provider SADAD Payment System gives companies a safe and dependable platform for accepting payments. Customers trust it because of its dependability, simplicity, ease of setup, and compatibility with a range of e-commerce platforms.

However, SADAD may offer limited international payment support, which could be a disadvantage for enterprises trying to expand their reach outside the local market.

The portal accepts a range of payment options, including credit cards, debit cards, and local payment systems. In order to assist businesses in managing their transactions, the SADAD Payment System also provides a number of services like real-time reporting and analytics. The SADAD Payment System levies a transaction fee of 1.75% + 0.25 SAR for every transaction.

Hyperpay

Hyperpay is the leading native Qatar payment gateway that enables businesses to accept and process payments online. HyperPay is a well-known payment gateway provider especially in Middle Eastern countries like Saudi Arabia, offering trustworthy and secure online business payment processing.

It provides a variety of services to many businesses and customers, including recurring billing, reporting, and payment processing.

The portal accepts a wide range of payment methods, such as regional choices like Mada and SADAD in addition to debit and credit cards. HyperPay offers a quick checkout experience in addition to user-friendly features like preventing fraud and real-time transaction monitoring. There is a 2.5% + 0.75 SAR transaction fee for each HyperPay transaction.

Amazon Pay

Amazon Pay is an online wallet-based payment service that enables users to make purchases using their wallet balance. It was introduced by Amazon in 2007. It is a convenient means of payment for millions of Amazon customers.

As of March 2023, the payment service is available to businesses in the United States, as well as Japan, France, Germany, and Denmark. They currently have more than 50 million UPI global users. Notable companies in the USA that employ this widely used payment gateway include BigCommerce, Brooklyn, Chico's, Forever 21, and Magento.

Amazon Pay integrates seamlessly with online stores and is designed for mobile applications. Moreover, it features Alexa capabilities, enabling voice-activated product addition and wish list creation.

Paypal

PayPal is probably one of the greatest payment gateways in the United States, with over 360 million active customers worldwide. With support for more than 100 currencies, the company celebrates more than 20 years of experience in the payment industry for global enterprises.

When you use PayPal for business, you can use a variety of techniques to increase revenue. PayPal's user-friendly payment gateway makes it the #1 choice among payment gateways in the USA! According to research, having PayPal as a payment option improves shoppers' intent to spend by 54%!

The payment gateway facilitates professional invoicing, automated payments, recurring payments, and "Buy Now, Pay Later" capabilities.

Shopify Payments

If you own a Shopify store, you can use Shopify Payments. Shopify is an easy-to-use payment gateway that provides a wealth of excellent assistance to get you up and running.

To activate online payments, simply enter your business information, wait for confirmation, and that's all. Using this native payment solution eliminates the need to configure and integrate a third-party platform, which may be time-consuming and stressful. To ensure seamless integration, you can reach out to the leading Shopify development company and you are sorted.

The plans, which start at $39 per month, provide you with the basic tools you need to sell online, including a website, marketing tools, and payment processing all in one location. As you progress through the paid tiers, you get more features while also securely lowering the payment processing fees.

Authorize.Net

Authorize.Net, founded in 1996, is trusted by over 430,000 merchants and processes over 1 billion transactions and $149 billion in payments annually.

The payment gateway got the top-performing payment gateway award in August 2020 due to the greatest rate of successful authorizations.

With the help of the Authorize.Net payment system, your company can provide clients with a range of payment choices, from digital payments like Apple Pay, PayPal, and Visa Click to Pay, to debit cards, credit cards, and eChecks.

One of the greatest online payment gateways in the USA is Authorize.Net, which also offers a simplified PCI DSS and sophisticated fraud detection. It also accepts recurring payments.

E-Commerce Payment Gateways Security Features for Online Transactions

Payment security measures include various technologies and standards to ensure the safe processing of transactions. So, while choosing the payment gateway provider for your eCommerce business, you need to choose some of the most important features such as:

Compliance with PCI DSS

Major card companies implement a set of standards and compliance guidelines known as the Payment Card Industry Data Security Standard (PCI DSS). Companies that process payments using credit or debit cards are required to adhere to PCI DSS. This compliance ensures that credit and debit transactions take place in a secure environment.

Secure Electronic Transaction (SET)

Secure Electronic Transaction (SET) is an encryption-based technology and electronic protocol created collaboratively by prominent card systems VISA and Mastercard. Fraudsters cannot obtain crucial information without authorization thanks to SET's extensive encryption. For added privacy and data protection, SET also prevents businesses from accessing the cardholder's information.

Data Encryption

E-commerce payment gateways use data encryption as their main method of protecting sensitive transaction data. When clients provide their credit card information throughout the checkout process, the payment gateway encrypts it.

After that, the payment gateway uses its private key to decrypt the transaction. It is quite unlikely that the data will be accessed without authorization thanks to this method.

Secure Socket Layer, or SSL

A secure Sockets Layer (SSL) is a security technology that creates a secure connection between a payment provider and a customer's web browser. It guarantees that any information sent via SSL is encrypted.

Tokenization

Tokenization is a crucial security method that can lower the risk of fraud when applied in online payment processing. It involves substituting distinct payment tokens for private account information, such as credit card numbers.

In the event of a data breach, attackers would be unable to utilize the tokens without actually using the payment credentials. Instead of sending the complete PAN, only the payment token is transmitted for authorization when a consumer wants to make a transaction. The customer and merchant don't have to resubmit their entire card information every time they utilize this token in future purchases.

Factors to Consider While Choosing the Payment Gateway for Your E-commerce Business!

Choosing your payment gateway for an e-commerce business is a big decision and can make or break your business. It can significantly affect your business reputation, sales numbers, customer experience, and much more.

Well, to make the decision easier for you, here are the most important considerations for making a decision:

E-commerce Payment Gateway Costs

Payment gateways usually charge a transaction fee. So, understanding the fees associated with a payment gateway is essential. You need to compare transaction fees, which can be a flat fee or a percentage of the transaction. On top of transaction costs, you need to consider the setup fees and ongoing costs, additional charges for premium features, and also be aware of hidden costs as well.

User Experience

Your customers don’t have all day to complete the checkout process. So, make sure to choose the payment gateway services provider that offers a user-friendly, intuitive, and quick checkout process. It helps you reduce your cart abandonment and boost sales sales.

Security Features

While choosing the payment gateway provider, you can’t forget about the security. Select a payment gateway with solid security features such as PCI DSS compliance, encryption protocols, and tokenization for the financial information of your customers.

Easy Integration

Integrating the payment gateway with the existing website or e-commerce platform should be easy, so you should look for gateways that offer seamless integration with popular shopping carts and website builders. Also, look after the proper documentation, easy integration guide, and technical support in case of any need.

Global Outreach

If you plan to sell internationally, select a gateway that supports multiple currencies and cross-border transactions. While choosing the payment gateway, you need to look out for features like dynamic currency conversion and multi-currency settlement to improve the shopping experience for global customers.

Customer Support

While evaluating your options, you can’t forget about customer support as it's important to help with issues that may arise during the payment gateway process. You should opt for a payment gateway service provider that offers responsive support through phone, email, and live chat. Good customer support ensures smooth transaction processing and minimizes downtime.

How to Find the Best Payment Gateways for E-Commerce?

Here’s the wrap about the ultimate guide to choosing the right payment gateway for your eCommerce business. And, with so many different options available and things to consider, making the choice can seem overwhelming.

But, don’t worry, we have got you covered. Sufalam Technologies is the leading eCommerce development company. We have a team of experts who will be able to understand all your business needs, your target audience, and the volume of transactions and recommend the most suitable eCommerce payment gateway for your online store.

On top of it, we can also help you with end-to-end seamless integrations to ensure a fully secure and seamless shopping experience for your customers.

So, what are you waiting for? Book a free consultation call with us & let’s get started!

Frequently Asked Questions

What are a few of the mandatory features to look into in an e-commerce payment gateway?

Key features to look at should include PCI DSS compliance, SSL/TLS encryption, tokenization, and security support.

How do third-party payment gateways differ from bank payment gateway processes?

Third-party online payment gateways, like PayPal or Stripe, act as intermediaries and offer easy setup, more payment options, and extra features. They are suitable for small to medium businesses.