No matter what you sell, you will require a few things: security, quality, and secure payment gateways. Unexpectedly, 18% of users abandon their carts because they don't trust the website with their credit card details, and 9% do so because there aren't enough payment choices.

Did you know that, by 2025, it is expected that worldwide e-commerce sales will reach almost USD 7.4 trillion, a 74% increase from 2020?

Therefore, for businesses to take advantage of this expanding industry, you must know how to handle online transactions. Integrating a payment gateway into your website is an essential step toward developing an eCommerce website.

Modern customers expect an easy, quick, and efficient online checkout process. By including a payment gateway into your company website, you can boost client confidence, excitement, and loyalty while also facilitating a simple and safe checkout experience.

By the end of this article, you’ll know the basics of a payment gateway, how it works, the benefits of payment gateway integration, types of payment gateway and the step-by-step guide to integrating an eCommerce website with a payment gateway. Let's dig in!

What is a Payment Gateway?

A payment gateway enables the authorization and processing of payments through data transfers. This digital technology facilitates the acceptance of several digital payments from customers, including electronic bank transfers, digital wallets, and debit or credit cards.

Payment gateways are intermediate services that securely verify, authorize or reject electronic transactions on behalf of an online retailer.

With the world becoming more digital, payment gateways are now found in practically all online and offline establishments. But, payment gateways do more than just take payments, this integration aims to increase conversion rates, improve customer satisfaction, and guarantee transaction security.

Here’s how the payment processing works:

- During the checkout process, the customer presses the "pay now" button.

- After choosing a payment option, they input the necessary card information.

- The payment gateway receives the updated information.

- The payment gateway provides the payment processor with the encrypted data.

- Once the bank receives the authorization request, it either approves or rejects it and notifies the payment processor.

- The customer's bank sends money to the merchant bank.

- The webpage appropriately shows the acceptance or rejection.

Did you know?

According to a survey, 17% of consumers gave up on their shopping basket because the checkout process was too difficult or time-consuming.

Why are Payment Integrations so important?

- They're safe: Payment gateways offer robust security measures, including encryption and tokenization, to protect sensitive customer information during transactions. It processes all payment-related data while protecting all parties involved by encrypting sensitive data. This is crucial for your own peace of mind as a business owner as well as the safety of your clients.

- They're simple to utilize: Payment gateways are made to be as user-friendly as possible for both your clients and the merchant. In addition to providing your clients with a quick and easy checkout process, they are also simple to set up and integrate into your website.

- Broad customer base: Payment gateways give customers from all around the world access to your store and make purchases through an easy and convenient payment process, which can significantly increase your customer base followed by the efficient and safe checkout experience encourages them to keep coming back for more.

- Faster transaction processing: Integrating a payment gateway automates the payment process, reducing manual tasks and the potential for human errors. While you integrate a payment gateway into your website, consumers can make purchases quickly and easily, enabling faster order fulfillment and improved operational workflow.

- Added convenience: If your store has a payment gateway, clients can easily shop from the comfort of their homes at any time of day or night. Your store will be open around the clock. Plus, it supports various payment methods such as credit and debit cards, digital wallets, and bank transfers that enhance the overall shopping experience for customers.

- Customer Trust: By providing a consistent and reliable payment experience, you reassure customers that their transactions are safe, fostering loyalty and repeat business. It enhances your brand's credibility and builds customer trust.

- Scalability: Payment gateway integration offers the flexibility to accommodate growing transaction volumes, supporting your business as it expands. Whether you're scaling up your operations or entering new markets, a reliable payment gateway can handle increased demand without compromising performance.

- Detailed Reporting and Analytics: Payment gateways offer access to detailed reports and analytics, providing valuable insights into transaction data. These insights help you track sales performance, monitor trends, and understand customer behavior, enabling informed decision-making. With comprehensive reporting tools, you can optimize your business operations, improve financial management, and drive growth.

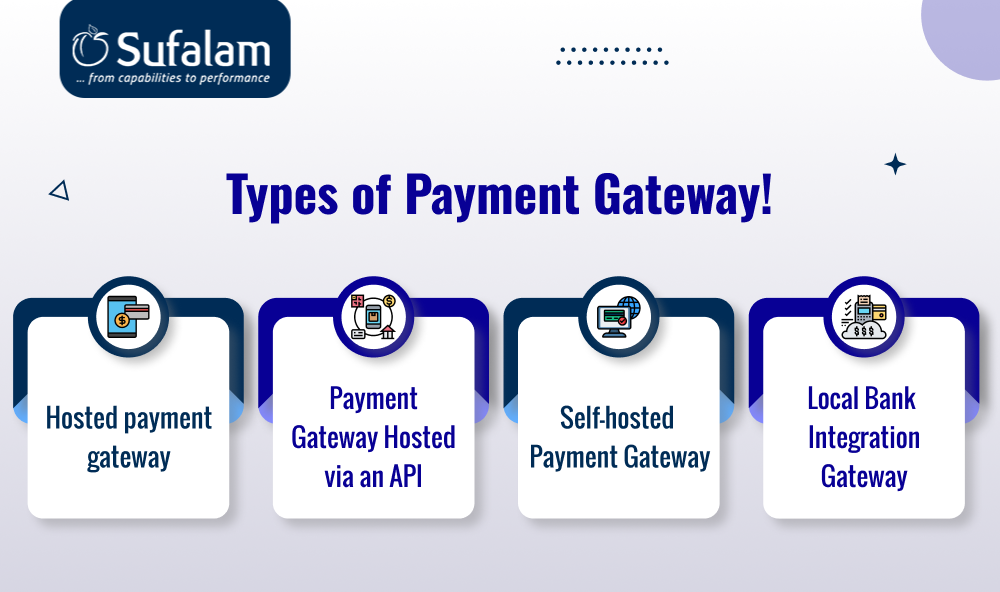

Types of Payment Gateway!

Each type of payment gateway has distinct advantages and disadvantages. Some emphasize the simplicity of payment integration in the website, while others concentrate on offering a flawless user experience or serving certain geographic areas. It is essential to comprehend these differences prior to choosing the best payment gateway for your website.

1. Hosted payment gateway

Customers using hosted payment gateways are redirected to a safe third-party platform to finish their transactions. Since the provider's platform handles the payment processing, this approach makes payment gateway integration easier for website owners. However, it frequently requires several redirections, which might negatively impact the user experience.

For instance, PayPal

2. Payment Gateway Hosted via an API

Payment gateways provided by APIs let users complete purchases right on your website. Using the Application Programming Interface (API) of the gateway provider, you can smoothly integrate a payment gateway into your website. Although it provides a more seamless user experience by keeping visitors on your website, its implementation calls for a higher degree of technical know-how, but you can always hire dedicated developers from the leading eCommerce development company to assist you and ensure the best results.

For instance, Stripe

3. Self-hosted Payment Gateway

Self-hosted gateways allow you to keep control over the whole transaction flow while hosting the payment process on your server. Though it requires close attention to security precautions to ensure safe transactions, this method offers greater customization possibilities and control.

For instance, Authorize.Net

4. Local Payment Gateway Integration

Local bank payment gateway integration in eCommerce offers a more specialized payment solution by integrating with particular banks directly. They let companies that serve particular areas or nations take payments through regional banking networks. This kind of gateway integration frequently calls for cooperation and compatibility with particular banking institutions.

After discussing the several kinds of payment gateways that are out there, let's go to a detailed tutorial on how to include a payment gateway in your website.

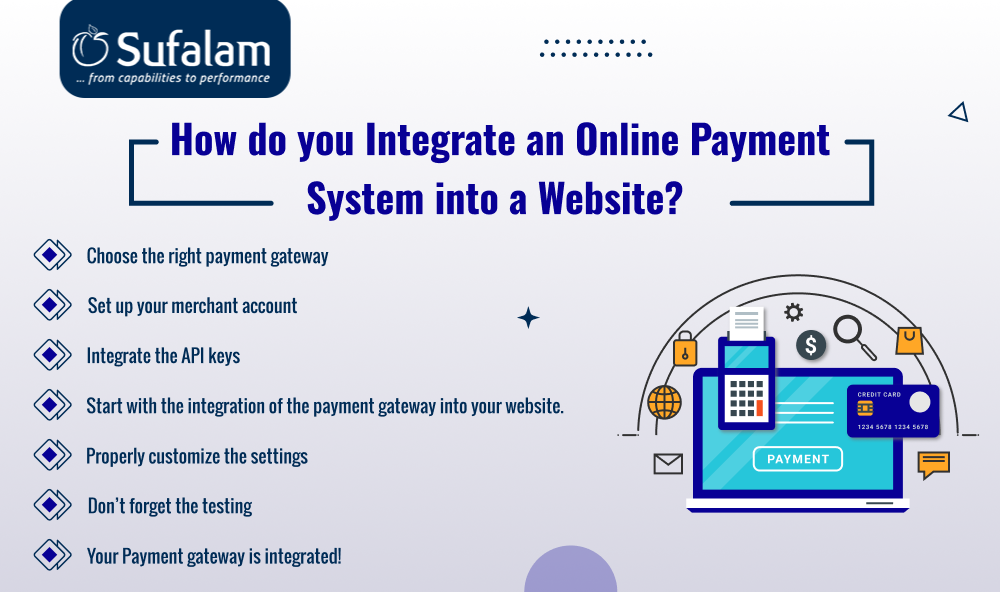

How do you integrate an online payment system into a website?

1. Choose the right payment gateway

The first step is to choose a payment gateway that complements your company's requirements. This is the most important stage, where you will be contemplating lot of things to make the right decision - as it can make or break your business. While making a choice, you can consider a lot of things such as transaction costs, acceptable payment methods, security precautions, and compatibility with your e-commerce platform.

2. Set up your merchant account

Depending on the payment gateway, you may or may not need to create a merchant account. It depends on your payment gateway provider. Some payment gateway providers need you to set up a merchant account from scratch, while others offer complete payment support with a streamlined setup by combining merchant account capabilities with the payment gateway.

3. Integrate the API keys

Once you have created an account with the payment gateway, you will usually need to get API keys. These are special codes that link the website or application of an online business to the services provided by the payment gateway. They are a system component that enables safe communication between the payment gateway and the business platform. Thanks to these keys, your website will be able to communicate with the gateway's server. To ensure seamless API key integrations, you can hire a dedicated developer and get the best results.

4. Start with the integration of the payment gateway into your website.

The following step is to integrate the payment gateway with your website. Depending on the payment provider and the platform of your website, this step can change substantially.

Some e-commerce platforms, like WooCommerce or Shopify, offer installable plugins/apps that allow a user to integrate third-party payment gateway apps easily. On the other hand, some other payment gateways provide API for integrations - for which you can partner with experienced developers or development companies to ensure seamless integrations

5. Proper Configurations are crucial

Configuring the payment gateway settings to suit your business requirements involves specifying accepted payment methods, setting currency preferences, and configuring additional security measures. You can ensure acceptance from major credit and debit cards, digital wallets like PayPal and Apple Pay, and other relevant payment methods such as bank transfers.

Here are some common configurations you can do: Set your primary currency based on your business location and enable multi-currency support to cater to an international audience. You can enhance security by configuring additional measures like 3D Secure, AVS, and CVV verification, and utilize the fraud prevention tools to minimize risks.

There are so many other as well, which you can alter based on your company’s needs. By tailoring these settings, you ensure a seamless, secure, and convenient payment experience for your customers.

6. Don’t forget the testing

Make sure everything is functioning properly by testing the checkout process after you've incorporated the payment gateway into your website. Typically, this includes utilizing a fictitious account to make a test purchase. For testing purposes, most gateways provide a "sandbox" or testing environment where you may make test purchases to make sure everything is operating as it should.

To activate it, navigate to Settings → Payments and choose the "enable test mode" checkbox. But before your clients start placing orders, make sure you remember to disable it!

7. Your Payment gateway is integrated!

Congratulations if you've tested the payment gateway and everything is operating as it should, now is the time to begin taking payments via your website.

Make sure to switch from the sandbox environment to the live environment to accept payments from your customers. For the final testing, you can even perform a few live transactions to ensure the system is working as expected.

After the deployment is completed, you should regularly monitor transactions, and performance and ensure security measures are up-to-date to protect against fraud and data breaches.

Sufalam Technologies is here to help!

Integrating a safe and reputable payment gateway with your website is quite important. They are an excellent way for agencies to capitalize on the ease and security it has to offer.

By following the steps - right from choosing the right gateway, and obtaining necessary API credentials to implementing, testing the payment integration in the website, and ensuring compliance with security standards—you can streamline transaction processes and begin taking advantage of everything they have to offer.

If you are still wondering how to do it, you can partner with an experienced eCommerce development company like Sufalam. You can hire developers, who can help you with the seamless integration, within just a few days!

So, without any further ado - book your free consultation!

Frequently Asked Questions

Which payment option works best for websites?

The most common methods for making online payments for services are debit and credit cards. However, depending on where they live, your consumers can prefer different methods of payment, such as mobile or bank transfers.

How secure are payment gateways?

Payment gateways use encryption and adhere to PCI DSS (Payment Card Industry Data Security Standard) to ensure that transaction data is transmitted securely, protecting both the merchant and the customer.