Table of contents

- What is an insurance price comparison website?

- What are some of the crucial features needed in the Price Comparison website?

- How to Build a Website that Compares Insurance Rates? The Step-by-Step Guide!

- Some of the leading insurance price Comparison websites across the world!

- How much does it cost to develop a website to compare insurance rates?

- To Conclude

People nowadays are looking for methods to save money on pretty about everything. According to Statista, 8 out of 10 internet buyers utilize price aggregators when purchasing online.

Price comparison websites, whether for credit cards, tickets, hotels, household items, groceries, or technological gadgets, have undeniably simplified the process of purchasing products and services online.

And this is also true when it comes to insurance, which is among the largest costs in the lives of most individuals. This is why insurance comparison websites have grown in popularity. If you're considering creating your insurance pricing comparison website, this article will help you get started.

In this blog, we as a leading website and web app development company will cover everything you need to know about how to build an Insurance price comparison website, some top insurance price comparison sites, the cost for the same, and other things. Let’s dig down!

What is an insurance price comparison website?

An insurance comparison website allows you to compare several insurance policies from various insurers. If you're trying to find the best deal or the appropriate coverage for your needs, it can be a helpful tool.

When using an insurance comparison website, there are a few things to bear in mind.

- To begin, be certain that the website is respectable and has a solid reputation. Some websites will try to take advantage of customers, therefore it's critical to conduct your research before using any service.

- Second, keep in mind that not every comparison website is made equally. Some simply compare a few insurers, whilst others allow you to compare hundreds of policies. The more options you have, the higher your chances of finding the best offer are.

- Lastly, remember to read the fine print. Certain comparison websites may impose additional costs or hidden fees that accumulate over time. Before you sign anything, be sure you are aware of all the terms and conditions.

What are some of the crucial features needed in the Price Comparison website?

- Quote Comparison: The core feature of the website should allow users to compare insurance quotes from multiple providers. The comparison should be detailed, showing different coverage options, premiums, deductibles, and other relevant policy details.

- Accurate and Up-to-date Information: The website must provide accurate and up-to-date information about insurance policies and pricing. Outdated or incorrect information can lead to customer dissatisfaction and mistrust.

- Detailed Policy Information: Each insurance policy should have detailed information available, explaining the coverage, limitations, exclusions, and any additional features. Transparency is essential to help users make informed decisions.

- User-Friendly Interface: The website should have an intuitive and easy-to-navigate interface. Users should be able to quickly understand how to enter their information, compare quotes, and make a decision.

- Customization Options: Users should be able to customize their search based on their specific needs, such as coverage limits, deductibles, and optional add-ons. Customization ensures that the quotes provided are tailored to the user's requirements.

- Mobile Compatibility: The website should be mobile-friendly, as many users access the internet via smartphones and tablets. A responsive design is necessary for a seamless experience across various devices.

- Security and Privacy: Users will be providing sensitive information, so it's crucial to have robust security measures in place to protect their privacy.

- Customer Support: Offer customer support options, such as live chat, email, or phone support, to assist users with their queries and concerns. Also, provide them with post-claim policy support when they need to file an insurance claim.

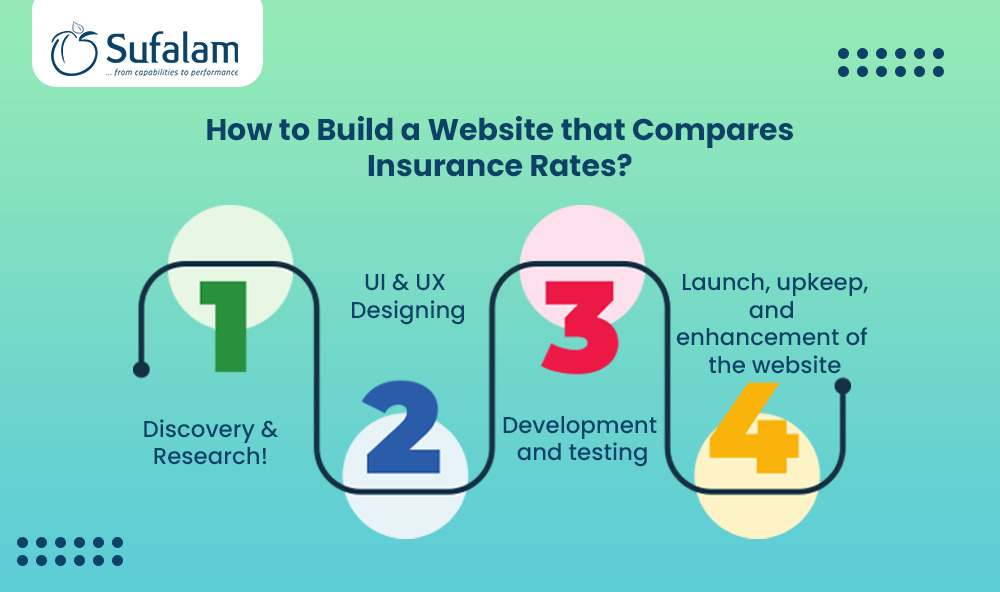

How to Build a Website that Compares Insurance Rates? The Step-by-Step Guide!

Stage 1: The Discovery & Researching!

The main purpose of the discovery phase is to gather data to create a feature-rich insurance comparison website that will aid in the startup's objectives. Your product development process's architectural basis will be created from the output of this phase. In addition, it will assist you in selecting the appropriate framework for the development of an insurance comparison website.

Stage 2: UI & UX Designing

A crucial step in the center of the development process is the design phase. Your website's impact on viewers, usability, browsing experience, and visually appealing and interactive designs all say a lot about it. The reason for this is that the design creates the ideal base for your website and entices users to visit and return.

The result of this stage should be a well-designed prototype that optimizes the platform's aesthetics and efficacy while also assisting in delivering top-notch adaptability, effectiveness, and interaction.

Stage 3: Development and testing

This is the core of the entire development process because it includes the implementation of all results from both the design and research phases, as well as actual coding. Frontend and backend developers are primarily responsible for the tasks at hand.

The outcome of this phase should be an MVP or a user-facing website that is completely scalable and includes all the features and capabilities of the prototype.

The term MVP, or Minimum Viable Product, refers to a simple website that has all the functionality required to do a pre-test to see if your idea is viable. After users are sufficiently pleased with your MVP, you may ask your developers to create an improved version with more sophisticated features for users to interact with.

Stage 4: Launch, upkeep, and enhancement of the website

What comes next once you've developed a user-friendly price comparison software that appeals to your target market? For convenient access, your software must be launched in app stores.

It's time to commit both resources and time to obtaining consumer feedback and implementing customer-focused changes based on that feedback. A fully devoted website development team is required to successfully launch, maintain, and upgrade an application.

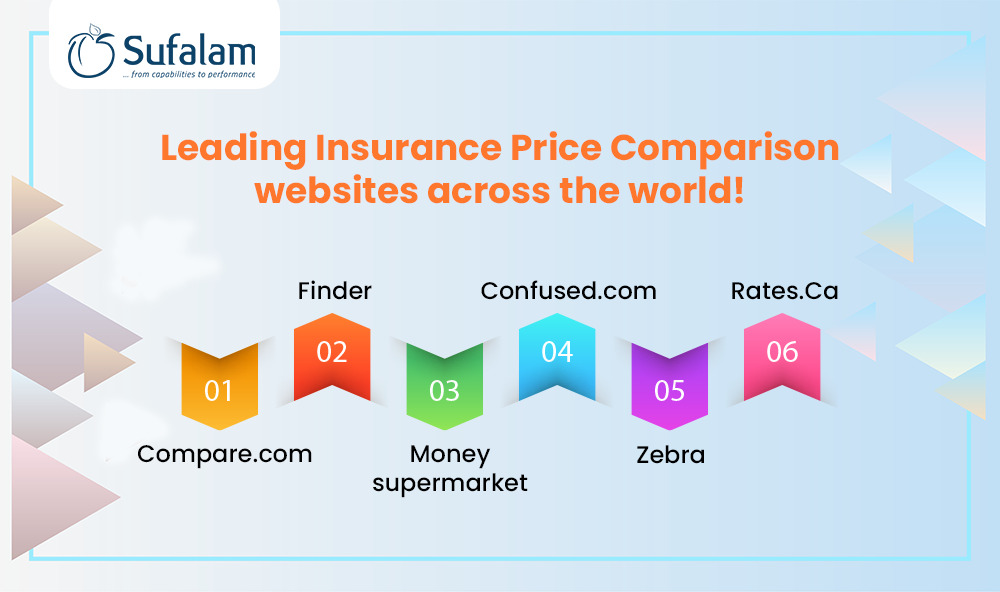

Some of the leading insurance price Comparison websites across the world!

Compare.com

This is quite a popular insurance price comparison company located in Virginia. It enables consumers to compare.com rates for auto insurance from more than 75 leading insurance providers, enabling them to get the best deal in a matter of minutes.

Although its primary focus is on car insurance, the company also provides home insurance. The business was also purchased by Insurify, and according to the industry database Crunchbase, it has raised US$185 million in capital during its existence.

Finder

Another well-known price comparison website in Australia is called Finder. This one-of-a-kind popular website to compare insurance rates, lets users compare a wide range of financial products, such as auto, home, and travel insurance. Since its founding in 2006, the company has grown and now has operations throughout several countries such as Australia, the US, the UK, Canada, the Philippines, Poland, and Singapore.

Money supermarket

Customers may compare a variety of insurance products, such as home insurance, auto insurance, life insurance, and pet insurance, on Moneysupermarket.com, the greatest price comparison website in the UK.

In addition, users can compare other financial goods like mortgages, credit cards, loans, and mobile phone contracts. Since its founding, its parent business, which has 700 employees and is headquartered in London, is said to have raised $300 million in capital.

Confused.com

Confused.com gives consumers the ability to compare several insurance policies, such as life, health, travel, pet, and auto insurance. It was established in 2002, during the early stages of the internet, and frequently refers to itself as "the first price comparison site," comparing rates from up to 160 reliable insurance companies to present users with the best deal.

In a world where shoppers can compare prices at the click of a button, services like these are extremely important to insurers.

Zebra

The Zebra, a Texas-based startup, is another insurance comparison website with an animal pattern that lets users compare quotes for home and auto insurance from more than 100 different providers.

It was founded in 2012 and is now the top insurance comparison site in the United States, with millions of users. They make it easier for customers to compare insurance quotes by seeking information only once.

Rates.Ca

Canadians may compare rates for credit cards, mortgage rates, travel insurance, house insurance, and auto insurance with Rates.ca. It collaborates with over 50 Canadian insurance companies to offer consumers the most competitive rates. By using Rates.ca, an average user can save CA$800 (US$605) on their insurance. The website was initially introduced in 2013, and the company's current headquarters are in Toronto, Ontario.

How much does it cost to develop a website to compare insurance rates?

The intricacy of the website and the features you choose to include will determine how much it costs to design a website that compares insurance rates. A Forbes Advisor article states that website development might cost anything from $100 to $5,000 or more.

As per Upwork, the price of creating a website is influenced by multiple elements such as the volume of pages, custom programming, website functions, and the hourly fee of the independent expert. Experienced freelancers can charge anywhere from $20 to $80 per hour.

Please be aware that these are only estimates and that the real cost of creating a website may differ based on the particular needs of the project. If you are looking for an accurate estimate, you can reach out to our leading web app development company and our team will guide you further.

To Conclude

A user-friendly and functioning insurance price comparison website saves clients time, increases sales for businesses, and becomes an excellent profit tool for those who own it.

The creation of a price comparison website is a challenging undertaking that calls for a significant time and financial commitment. However, if you approach this process correctly, you can build a great product that will generate a decent return on investment for your company.

If you are interested in building a pricing comparison website or have an idea for a comparable project in this field and are searching for a reliable technical partner to help you achieve it, please contact Sufalam Technologies.

We are a leading website development company, with a team of skilled developers who will understand your diverse needs and offer personalized solutions accordingly.

To discuss this further, we are just a call away!