The financial technology sector has grown significantly in recent years, with innovative startups reshaping traditional banking and payments. Consumers can now handle routine financial tasks without having to stand in long lines at physical bank branches and can get it done digitally within just a few clicks. Plus, there are so many innovative fintech startups as well, to offer that enhanced convenience.

As per McKinsey’s Report, revenues in the fintech industry are expected to grow 3x faster than those in the traditional banking sector between 2023 and 2028.

Fintech apps have completely changed the way businesses and consumers interact with financial services. Fintech startups disrupt the traditional financial services landscape by utilizing cutting-edge innovations, making financial services more accessible and affordable to all. This has given customers easy access and convenience to everything finance-related.

In this article, we will take a closer look at the fintech market and the best fintech startup ideas to consider in 2024.

Why is Fintech Constantly Growing: The Market Overview!

Fintech, which stands for financial technology, combines finance and sophisticated technology to improve and automate financial services.

The global fintech market is dynamic and always changing due to a number of factors including ongoing technological innovation, shifting consumer preferences, new regulations, and strategic alliances between various market individuals.

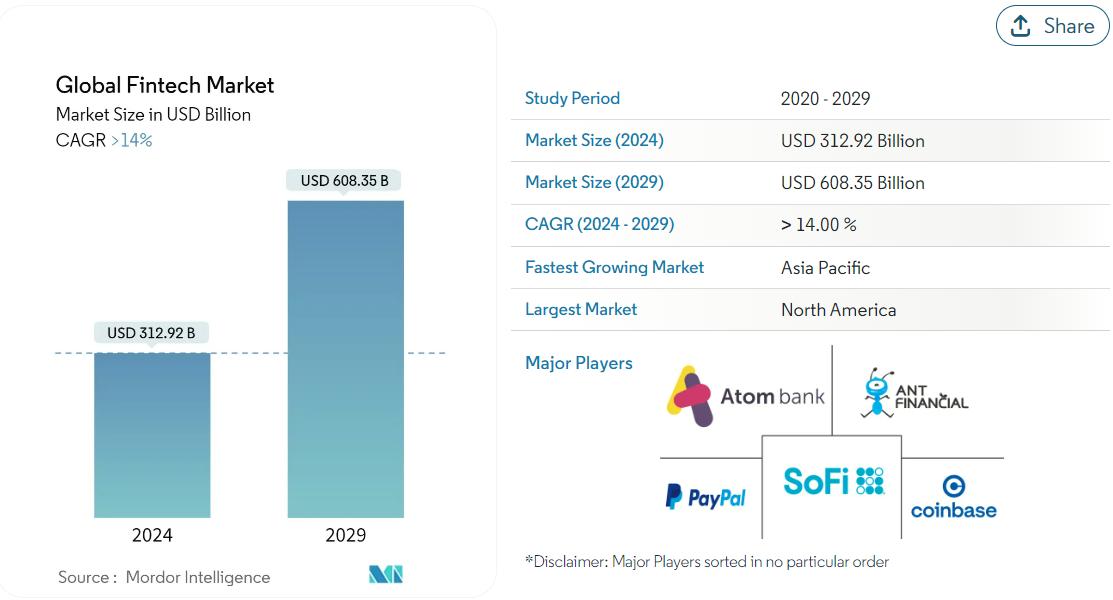

The fintech market is expected to reach USD 608.35 billion by 2029, growing at a compound annual growth rate (CAGR) of more than 14% from its estimated USD 312.92 billion in 2024.

Source: mordorintelligence

Fintech apps are transforming the financial services industry by providing easy-to-use digital solutions that improve security, efficiency, and accessibility for both consumers and businesses.

10 Profitable Fintech Startup Ideas to Know About: Check Out the Full List

Digital Wallets

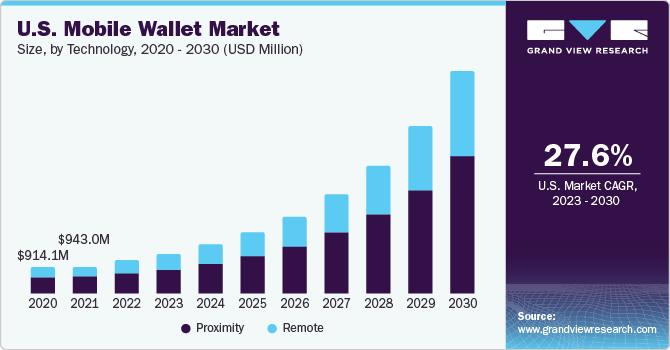

The market for digital wallets is expanding rapidly as a result of consumers' ability to avoid carrying physical wallets or credit/debit cards. With just a few taps, users of these applications can quickly make payments and receive offers and coupons that are very profitable.

Grand View Research estimates that the global digital wallet market was valued at $7.42 billion in 2022 and will expand at a compound annual growth rate (CAGR) of 28.3% between 2023 and 2030. Businesses should think about investing in digital wallets as a calculated move to take a piece of this quickly growing market, given their capacity to expedite transactions and provide value-added benefits.

If you are willing to make a move, make sure to research what others are doing and how you can stand out from the rest. For further consultation, you can even connect with a trusted fintech development partner.

Personal Finance Management Apps

One of the best fintech startup ideas for businesses is the personal finance management application, which is gaining popularity as consumers become more aware of their income and savings.

With a projected CAGR of 24% from 2024 to 2030, the personal finance apps market, estimated to be worth $101 billion in 2023, is expected to grow to $450.8 billion by 2030. Thus, this is the ideal team to begin developing the greatest application for financial management.

This allows app users to track and classify their income and expenses in real-time, giving them an improved awareness of how to manage their money wisely and successfully. Along with automatic payment reminders, these personal finance app ideas enable users to connect all bank and credit card accounts and refresh the data.

P2P Payment Solutions

One of the most profitable fintech startup ideas for entrepreneurs is creating a feature-rich peer-to-peer (P2P) payment app, which makes it simple for users to transfer money to friends, family, and merchants.

Peer-to-peer (P2P) payment apps such as Venmo, Google Pay, Zelle, and PayPal offer users the ability and convenience to instantly transfer funds between bank accounts, even if they are registered with separate payment systems and banks. They are reducing the need to pay commission fees or use third-party middlemen to complete transactions.

Additionally, these fintech mobility solutions leverage innovative technologies such as facial and voice biometrics, NFC, and streamlined point-of-sale processing to improve risk management, optimize customer experience, and ensure end-to-end security.

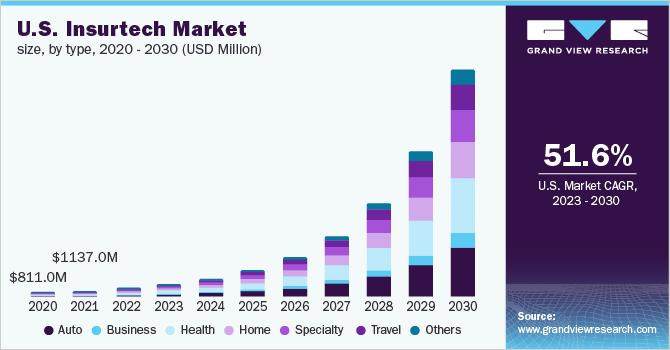

Insurance App

Creating an app specifically for insurance clients is yet another trending fintech idea. It can help you grow your business, especially if your company provides insurance services, even if only indirectly. As a result, the global insurtech market, which was valued at $5.45 billion in 2022, is projected to grow at a CAGR of 52.7% between 2023 and 2030.

Insurtech applications employ artificial intelligence (AI) and data science to gather, handle, and assess client data, pinpoint potential risks, and streamline the insurance underwriting procedure. Insurance companies can improve customer service quality and expedite operations by utilizing fintech app solutions.

This segment's apps target a variety of insurance domains. For instance, the international health insurance provider Cigna developed the myCigna app, which assists users in tracking their medical costs and filing insurance claims.

Allstate Mobile is a car insurance app that allows users to quickly submit insurance claims and includes a variety of additional advantages for car owners.

Lending Apps

Historically, obtaining a short-term loan required extensive documentation and significant effort. Without the help of a financial institution, a loan lending app, also known as a P2P lending app, serves as a marketplace where borrowers and lenders can interact and meet each other's needs. It is also one of the industry's hottest fintech app ideas.

Lending apps, which use artificial intelligence (AI) and big data analytics, streamline the loan assignment process by evaluating consumer information, credit history, behavior patterns, and purchase history to determine a customer's loan eligibility. Peer-to-peer lending, or borrowing money from other people, or banks may be the source of the funds borrowed through lending apps.

MoneyLion is a fantastic example of a lending and savings fintech app. The software has excellent reviews, a steadily expanding user base, and also assists users in managing their personal finances. If you are willing to get started with this best fintech startup idea, the lending app, look out for hiring dedicated developers from leading fintech companies for end-to-end consultation and development.

Payments & Bills Alerts Apps

A bill reminder application is a FinTech app idea that allows users to track and pay their bills on time. It can be a useful tool for people who are frequently busy or forgetful, allowing them to avoid late payment penalties. This is a useful tool, and it's a profitable fintech startup idea if you're looking to get started.

Generally, bill reminder apps let users input their bills, along with the amount and due date. In order to ensure that the user pays their bill on time, the app notifies them before it is due. Some apps also allow customers to set up automatic payments, which eliminates the need to think about it.

You can get started with this fintech startup idea as a standalone business or integrated into other financial apps, such as personal finance management or budgeting tools.

Buy Now Pay Later Apps

The FinTech industry is seeing a considerable increase in the adoption of Buy Now, Pay Later (BNPL) applications.

Customers who choose to "Buy Now, Pay Later" can make purchases right away and pay for them in installments later on. Users have the option to spread out their payments over time, usually in interest-free installments, as opposed to paying the entire amount at once.

With a 40% YoY volume increase, BNPL is one of the FinTech segments that is expanding the fastest. Due to a number of advantages these financing options have over traditional payment methods, they have become incredibly popular in recent years.

Because of its benefits and customer preferences, merchants are looking to add it to their payment processing. So, if you are looking to tap into a growing market, developing an appealing application and process around it is important. To get the best results, you can reach to leading fintech mobile app development company, that can understand your requirements and offer the desired solutions.

Stock Trading Fintech App Idea

Among the most popular fintech app trends in the financial world right now are those for trading stocks and other assets. To significantly improve trading results, trading and investment apps combine blockchain, artificial intelligence, and machine learning in fintech apps.

Algorithmic trading removes human error and emotional influences, makes data-driven decisions, responds quickly to changes in the market, and allows traders to trade simultaneously from multiple accounts. Users can quickly gain insight into possible investments and make well-informed decisions with the use of AI and data analytics. Users can learn about investing and trading.

Robinhood is one of the trading apps that is rapidly taking the US market by storm. This app for investment and stock trading has a market value of more than $7.5 billion.

To get started with this profitable business idea and develop a fintech app, connect with the leading mobile app development company that can understand your requirements and offer solutions accordingly.

Cryptocurrency App

The reason for the enormous popularity of cryptocurrency apps is that they eliminate middlemen. For a startup, creating a cryptocurrency exchange platform can be very beneficial because the market is expected to grow at a CAGR of 28%.

Crypto exchange platforms make it easier to trade cryptocurrencies for fiat money like Bitcoin, Ethereum, and Litecoin. These apps occasionally enable exchanging cryptocurrency for other assets. If you intend to own cryptocurrency trading apps, you will act as an intermediary between buyers and sellers.

Partner with the top cryptocurrency wallet app development company to create an intuitive and user-friendly application. They will comprehend your business's needs, provide you with a quote of the cost to develop a fintech app, and provide you with a solution that simplifies user exchange.

Block-Chain Based Apps

Blockchain-based fintech solutions are a popular startup idea because they have the potential to completely transform the financial industry. Blockchain is a distributed ledger technology that makes transactions safe, observable, and impermeable to tampering.

Some particular instances of blockchain-based financial technology solutions that might result in profitable ventures:

- Cross-border payment platform: A blockchain-based platform that facilitates quick, affordable, and safe cross-border payments.

- Microfinance Platform: A blockchain-based platform that offers microloans to underserved individuals from traditional financial institutions.

- A platform for tokenized assets: An online investment tool where users can purchase tokenized assets like stocks and real estate.

- Decentralized exchange: A decentralized exchange eliminates the need for a central middleman and enables users to trade cryptocurrencies and other digital assets.

- Compliance platform: A blockchain-based platform that automates compliance procedures and lowers fraud risk.

Don’t Forget the Regulations & Compliance in Fintech.

Financial services are among the most heavily regulated sectors, and fintech companies must navigate a complex landscape of legal, regulatory, and compliance requirements. Regulatory compliance costs banks $270 billion annually on average.

Ensuring regulatory standards and compliance is quite important in the fintech industry. And, many companies struggle to do it, because they don’t have enough know-how to ensure end-to-end compliance and meet the regulatory standards, set forward by various regulatory bodies in fintech.

While starting a fintech business,

- you need to secure the necessary licenses

- adhere to anti-money laundering (AML) laws,

- data protection rules,

- and specific financial regulations like the Payment Card Industry Data Security Standard (PCI DSS)

- and the General Data Protection Regulation (GDPR) in the European Union.

For fintech startups, ensuring compliance not only helps avoid legal penalties and fines but also builds trust with customers and partners. It demonstrates a commitment to protecting consumer data and operating within the bounds of the law, which is essential for gaining user confidence and fostering a reliable brand.

To Conclude

Fintech remains one of the most vibrant and dynamic sectors in the tech industry, presenting vast opportunities for both new entrepreneurs and existing investors in the finance industry.

This is the perfect time to step into the fintech market and leverage these fintech startup ideas to your benefit. So, to help you out we have added 10 best and profitable fintech startup ideas for entrepreneurs to know about in 2024. Each idea offers a unique approach to solving financial challenges and providing customers with something meaningful.

If you're looking to disrupt traditional banking, streamline payments, or offer new financial insights, these startup concepts are your gateway. In order to fully embrace the potential of fintech, we recommend you to research well or reach out to a leading development company and hire dedicated developers, who can help you with end-to-end consultation along with development.

To book a free consultation with Sufalam Technologies, reach out to us right away!

Frequently Asked Questions

Which is the best programming language to develop feature-rich fintech apps?

The most widely used programming languages for fintech apps are Java, Python, C++, C#, Ruby, etc.

What are the must-have features in a fintech app?

Fintech apps come with strong security options like facial recognition and two-factor authentication. They support specific financial tasks, can scan QR codes, and work with other apps to add more features. They also use AI for customer support and send personalized updates to users. It also includes features like spending trackers and budget tools to help manage finances better.