Table of contents

- What is a Fintech Application?

- Types of Fintech applications!

- Features Needed in a Fintech Applications: Everything Explained!

- Digital wallets and payment processing:

- Data management and analytics

- Security Protocols

- Live chat and chatbots for support

- Artificial intelligence (AI) for analytics and data visualization

- Use-safe authentication techniques

- Blockchain integration for financial applications

- Sophisticated alerting system

- Opt for a Transworthy hosting company

- To Conclude

- Frequently Asked Questions

Technology has a role to play in every business or economic subsector, from the most basic to the most complicated and advanced—one of the most common industries that rely on technology is banking. Fintech is a thriving industry propelled by cutting-edge technologies such as APIs, artificial intelligence, and blockchains.

Fintech (financial technology) is one of today's most popular technological sectors; consumers use fintech applications almost every day, from online shopping to mobile banking transactions.

The number of people using digital banking is predicted to increase from $197 million in 2021 to $217 million in 2025, with the FinTech industry size forecast to reach $699.50 billion by 2030.

The biggest businesses support this expansion by bringing in fresh capital and putting technologically advanced ideas into practice.

The following are the primary causes of fintech's global rise:

- the use of blockchain technology across multiple industries

- FinTech bolsters the security of financial data

- the expanding need for electronic payments

Let’s dig down to learn more about the Fintech Industry, Required Features in the Fintech app, fintech app development costs, and other things around.

Let’s dig down!

What is a Fintech Application?

Fintech is a combination of the phrases "financial technology" and "technology." It refers to an app, software, or technological advancement that enables individuals or organizations to digitally access, manage, or obtain financial insights or execute financial transactions.

Peer-to-peer (P2P) lending apps, investing apps, cryptocurrency apps, trading platforms, automated portfolio managers, robo-advisors, mobile banking, payment apps, and trading platforms are just a few of the many fintech application types.

Fintech businesses frequently employ technology to alter the way that customers engage with the financial sector. Fintech is democratizing financial services by making it simpler for people to use, share, save, invest, and manage their money.

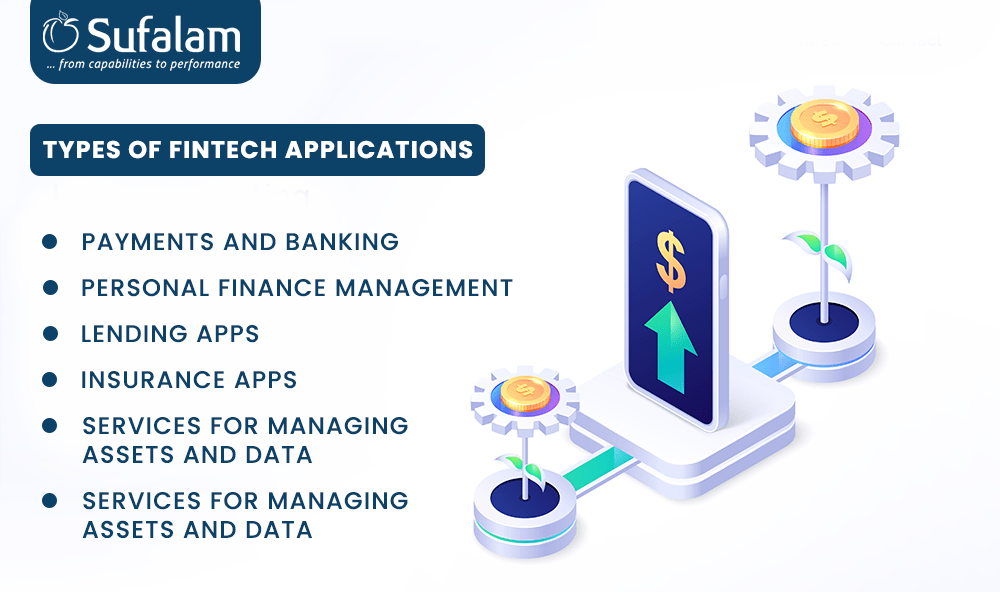

Types of Fintech applications!

Payments and Banking

Fintech apps for payments and banking usually let users transfer, save, and monitor their money online. Additionally, they make it simple for customers to pay with their smartphones or other devices. Venmo, Cash App, Robinhood, and PayPal are some examples of this type of financial app.

Personal Finance Management

Users may track and manage their funds more skillfully with the help of personal finance fintech apps. Fintech applications offer a multitude of functionalities to users, including savings objectives, investment monitoring, and budgeting tools. Mint, Acorns, and Stash are a few examples of this type of fintech app.

Lending Apps

Right now, the P2P lending market is growing rapidly. Businesses are forming partnerships to enable clients to apply for loans online. This industry makes use of technology to provide clients with financial solutions by using speedier and more accurate procedures. With these kinds of apps, it is easier to project income, evaluate the borrower's credit history, calculate the collateral's worth, and foresee changes.

Insurance Apps

Fintech companies that deal with insurance are presently working to digitize the services they offer. FinTech can offer variable-rate coverage policies that are more reasonably priced through applications.

With an insurance app, the end-user can access policies across many lines. It facilitates easier and faster engagement. It provides the user with faster claims processing, leading to an expedited closing of the agreement.

Services for managing assets and data

These apps let corporate and individual asset owners keep an eye on and maintain their assets while making the most out of their investment portfolios. They facilitate easier reporting of financial information and assist in maintaining an organization's legal compliance while managing its financial data. Acorns, Morningstar, Robinhood, Asset Class, T-REX, and Arcesium are a few examples.

Alternative credit scoring services

These services help determine a customer's eligibility for credit by utilizing data from various sources, departing from the conventional credit score paradigm. It contains details about an individual's past payments for utilities, telephone service, and rental agreements, among other things. Two examples of the same are Moody's Analytics Pulse and Nova Credit.

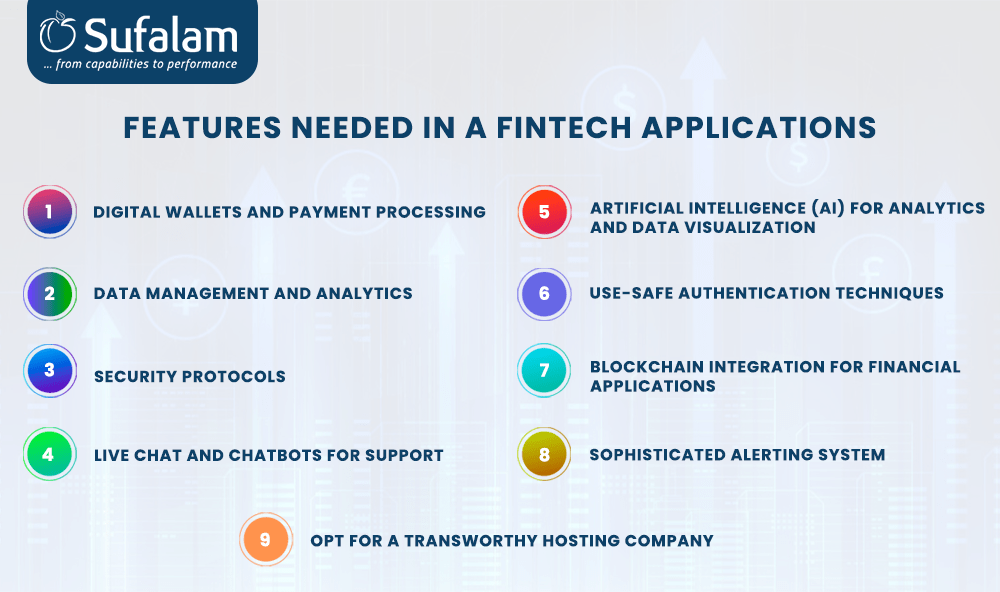

Features Needed in a Fintech Applications: Everything Explained!

Digital wallets and payment processing:

Both client data storage and payment processing should be possible with the FinTech app. Fintech organizations may need to incorporate payment gateways such as PayPal or Stripe, two-factor authentication, or other security methods in order to guarantee safe transactions.

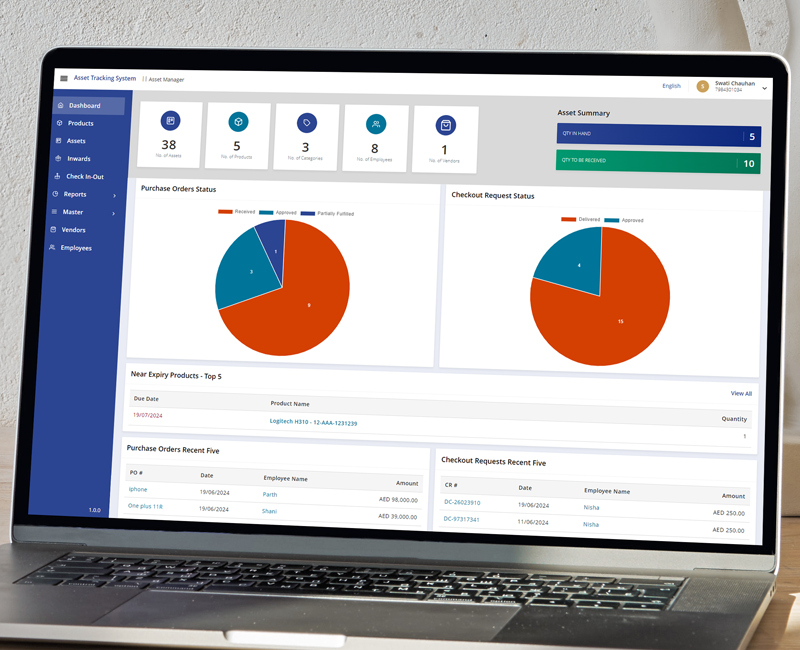

Data management and analytics

A fintech application must be able to gather user data and examine it for patterns and information that might guide future product choices. In order to do this, a platform for managing customer accounts and data must be created, and analytics tools that can identify significant trends in the data must be included.

Security Protocols

Since fintech applications deal with sensitive data, they need to be able to keep user information safe from malicious entities and attacks. Fintech apps have strict security standards, therefore it's critical to integrate strong cybersecurity measures like encryption and secure code. Fintech companies also need to periodically test their systems to make sure they are sufficiently secure and keep up with the most recent security threats.

Live chat and chatbots for support

By including these capabilities in your app, users may get real-time assistance without waiting for a call or an email answer. According to research, 79% of companies that integrated conversational banking and live chat into their apps saw increases in sales, profits, and client loyalty.

Artificial intelligence (AI) for analytics and data visualization

Another essential component of financial applications is AI. In-app data analysis and visualization depending on individual needs and industry trends can be offered to users. By analyzing financial data, artificial intelligence (AI) may develop clearly readable reports by analyzing stock patterns and offering data-backed investment suggestions.

Use-safe authentication techniques

Make use of an easy and safe authentication technique, including multi-factor authentication, biometrics, or single sign-on. While enabling simple user control functions like account setup, password recovery, and profile updating, this functionality safeguards user data and financial activities.

Blockchain integration for financial applications

At the moment, blockchain is establishing itself gradually and offers a dependable user experience. Additionally, it provides risk management with more extensive backing based on financial and economic activities. Regarding blockchain's adoption in the majority of services offered, the majority of FinTech companies are more upbeat.

Sophisticated alerting system

The notification panel is deemed essential for FinTech applications. As a result, the majority of FinTech applications can track more logins, ATM transactions, money transfers, and other activities. A FinTech application user can instantly detect any fraudulent account activity and receive real-time notifications with the help of such great features.

Opt for a Transworthy hosting company

Choose a trustworthy and secure hosting company that complies with industry standards to ensure your financial app includes features like data encryption, backups, and disaster recovery. It guarantees the safety, accessibility, and integrity of the data and services included in your app.

The Fintech app development cost segmentation is crucial to comprehend if you want to build a Fintech app.

The price of developing a FinTech application is not set in stone, though. The criteria and goals of each firm are different, which influences how much it costs to build a FinTech app. An app's price is determined by a number of elements, such as its kind, features, functionality, scope, complexity, app development framework, and overall development time, in addition to the agency's location.

Consequently, if trying for fintech mobile app development, it is imperative to take all of these variables into account.

The fintech mobile app development cost that provides users with a safe and simple online transaction method may start at a minimum of $40,000. It takes three to four months to develop.

A banking application with a limited user interface and functionality, on the other hand, can cost somewhere between $30,000 and $50,000. It might cost anywhere from $60,000 to $100,000 to integrate new and improved solutions with existing technologies in a FinTech app. An incredibly sophisticated fintech app development costs somewhere around $250,000.

Please get in touch with our mobile app development company if you want to know how much it costs to develop a fintech app. Our team of professionals will comprehend your requirements and provide you with a precise quote.

To Conclude

Here’s a complete wrap on everything you need to know about the Fintech app development. Right from the basics and essential features needed in the Fintech Application to the estimated cost to build a Fintech app, this blog is your go-to guide.

The majority of businesses are progressively moving toward using financial applications. And this is just the beginning.

The fintech industry is predicted to grow dramatically in the future years, giving up a plethora of new possibilities and opportunities for businesses and their clients. Nonetheless, creating a fintech application necessitates careful market research, comprehensive knowledge, and strategic strategy.

As a result, collaborating with a reputable fintech app development company can be beneficial.

So, why delay if you're thinking about investing in fintech app development?

Now is the moment!

Connect with Sufalam Technologies to hire a team of competent developers to take your company to new heights.

Frequently Asked Questions

How much time is needed to create a FinTech application?

A basic FinTech app could take three to six months to develop. The time required to construct a FinTech app might range from 12 to 18 months, depending on the complexity of the project, the requirements, and the FinTech application development options you select.

What advantages come with developing financial apps?

Creating a fintech app has numerous advantages, such as automating the entire process, facilitating accessibility, being quick, easy, and affordable, offering security and transparency, allowing personalization, minimizing paperwork, improving the user experience, and many more.

Fintech app development companies offer what types of benefits?

– Comprehensive experience in FinTech development

– Top-tier scalability and performance with regulations-compliant software

– Including P2P payments and payment gateways in mobile devices

– Utilizing cutting-edge technology to deliver solutions that are safe and of the highest caliber.

– Working with a team of professionals that stays up to date on the newest trends and best coding techniques.