Today, a fundamental change in technology breakthroughs has reshaped the worldwide digital era. Technology is constantly undergoing a transformation in almost every industry in this internet age. T

echnology has developed into an inherent, necessary component of society and the business environment, from work automation to online banking services, online communication to smart homes, cloud computing to business intelligence.

Banking, like all businesses, is not an exception whenever it comes to digital change.

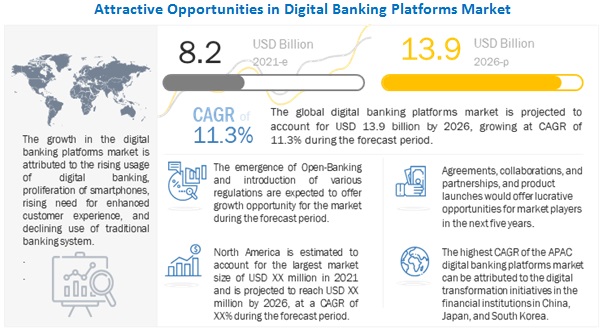

According to a research by MarketsandMarkets, the worldwide demand for digital banking platforms is anticipated to develop at a CAGR of 11.3% from USD 8.2 billion in 2021 to USD 13.9 billion in 2026.

Banks can implement a wide range of features with the help of digital transition, including website optimization, virtual agents, data encryption technology, and other mobile app development services like online banking applications,

To know more digital banking transformation and some of its most crucial components, keep reading!

Here’s more about digital transformation in banking!

The organizational and cultural movement toward integrating digital technology into all parts of the bank, optimizing operations and value generation to clients is referred to as digitization in banking.

If carried out effectively, digital transformation can increase the bank’s capability to compete in a market that is becoming more saturated.

Analyzing digital client behavior, interests, preferences, likes, dislikes, and stated and unstated expectations is the first step in successful digitization in banking.

Banks must address the cultural issues and mindsets that prevent businesses from embracing new technologies. Banks currently have a rare opportunity to modernize procedures and carry out digital transformation plans. Over the coming ten years, taking action now could spell the difference between success and failure.

Top trends banks are using for transformation!

Blockchain

Blockchain is essential to any discussion of digital banking implementation. The adoption of blockchain in the financial industry has led to safer data transfers, more precision, and improved user interfaces.

Modern consumers have a strict faith in blockchain technology and think it has improved the convenience and transparency of banking transactions. In fact, one of the largest developments in digital banking technology has been the integration of blockchain with IoT (BIoT).

Cloud computing

The use of cloud computing in banking improves the efficiency of financial institutions and hastens the expansion of online banking services. Pay-as-you-go makes it simple for individuals or companies to only pay for cloud consumption.

Cloud computing aids in the promotion of secure online banking services which includes electronic wallet, and other financial services in the banking sector. Banks can lower data storage costs by reducing capital and operating expenses while maintaining client data protection by utilising cloud-based solutions.

Cloud-based solutions are being increasingly adopted by banks to promote communication, enhance teamwork, and deliver better services to their clients.

Artificial Intelligence & Machine Learning

Machine learning and artificial intelligence (AI) (ML) Virtual assistants and chatbots use AI-based banking tools to give consumers the knowledge they require to address a variety of issues.

In addition to enhancing customer satisfaction and supporting digital transformation in banks, AI is useful for organizing, analyzing, and safeguarding data. Analytics powered by AI can even quickly process customer data to find recurrent patterns.

A related idea is machine learning, which enables banks to gather, store, and compare consumer data in real-time. Fraud prevention is among the key advantages of using ML in the banking industry.

Customer protection is increased by the machine learning system’s ability to quickly identify changes in user behavior and take proactive steps to stop data breaches.

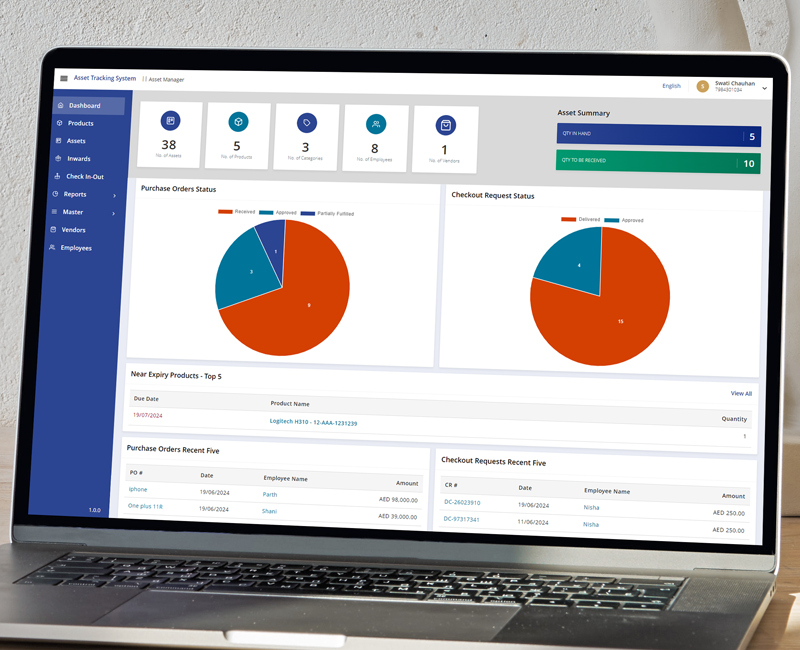

Big Data Analytics

Customers’ perceptions of the banking industry have changed during the past 10 years. Big data-based solutions assist banks in managing feedback, monitoring risks related to certain people or entities, analyzing client spending habits, and fostering customer loyalty.

Big data insights can be used by many banks to satisfy and keep clients. Financial institutions can react swiftly to changing market needs thanks to data analytics technologies, which present new potential for the banking sector.

Internet of Things(IOT)

The Internet of Things connects objects and sensors in a network to deliver cutting-edge, data-driven analytics. With major investments in internal infrastructure and customer-facing capabilities, IoT has become increasingly important in online banking services, particularly in retail banks. With some of the current use cases listed below, IoT can be used to implement multiple financial solutions.

IoT technology gives banks the ability to manage and keep an eye on a customer’s financed assets, including machinery and automobiles. It is essential for improving accuracy and gaining new perspectives. You may improve your decision-making for effective wealth management with the aid of these insights.

Through the scanning data gathered during customers’ visits to banks, Internet of Things (IoT) technology enables banks to anticipate their customers’ demands and offer a customized customer experience.

Benefits of Digitization in Banking!

Predictive ability

Your ability to succeed financially depends on your ability to foresee the issues and changes that will affect your market in the future. It is quite easy for you to get ready beforehand if you have dependable knowledge of various prospective events, from minor ructions to a catastrophe in the world economy.

By doing so, you can either move your company to a different, more promising, and lucrative sector before your rivals and implement winning Fintech solutions ahead of them.

Cost efficient

To conduct transactions and maintain accounts, traditional banks have long depended on a complicated system of checks and balances. However, this approach is ineffective and expensive, and it exposes institutions to financial mistakes. By streamlining many of the steps needed in transactions, digital banking software provides a more cost-effective option.

By greatly reducing the time and resources needed to complete transactions, this automation can lower the possibility of expensive errors. As a result, digitization in banking can assist them in strengthening their bottom line by lowering operating expenses, which raises revenues, conserves resources, and improves customer service.

Personalized offers for the customers.

Customers appreciate timely offers that address their specific needs but detest receiving generic offers that they don’t require. Digital transformation can accomplish everything. Effective consumer data analysis is made possible by software that contains the proper analytic, data mining, and processing components. You will be able to modify your offers using the obtained customized data, which will eventually increase consumer adoption and revenues.

Automating tasks

With the rise of the sophisticated online financial management platform, it has become quite easier for banks to manage compliance. The staff spend lesser effort in evaluating information and paperwork due to advanced solutions like automated checking.

Digital information manages its standardization and can be easily exchanged between different platforms.

Furthermore, because the cloud-based electronic payroll system upgrades quickly, banks do not have to be concerned about keeping up with evolving regulations.

Offering convenient accessibility

The two key components of digital banking are User verification methods and risk evaluations. They help banks to serve consumers swiftly and easily, allowing individuals who aren’t bank customers to obtain financial services.

Digital banking has the key benefit of always being accessible. Customers may now conduct any transaction from any location and access a variety of online banking services for less money than they would pay at traditional banks in terms of fees and interest rates. Banks can serve a huge audience at your convenience moment and from their convenience place thanks to their continuous and remote accessibility.

Better customer experience

Experience Banking providers strive to meet consumers’ minimal requirements for simplicity and convenience by minimizing friction for their customers.

Based on the various expectations of the client, providers must determine the most crucial elements of the consumer experience. In the end, they want to digitize the whole procedure to satisfy customer experience requirements and free up workers for higher-value jobs. Each element of the digitized, better customer experience has a huge impact on the banking sector as a whole.

To conclusion

Technology in the financial sector will be unrecognisable from what it is now in 5 to 10 years. Industry leaders may move faster to implement technology initiatives that will help them stay current and competitive in the virtual environment if they quickly acknowledge and accept this truth.

The advantages of digital transformation in banking sector are numerous. Big banks are starting to gain from technology adoption as tech-savvy fintech companies enter the market.

Using technology, banks may improve their offerings, draw in new clients, give workers more freedom, and streamline processes. Only when technologies penetrate all both internal and external levels of a bank’s operations can they help shape the future.

It’s a chance to reinvent financial services and transform banks into customer-focused, innovation-driven, and future-ready organisations.

To get the best-in-class banking mobile app development services, reach out to Sufalam Technologies right away!