Since the dawn of the digital age, the idea of buying now and paying later has become increasingly popular. After all, who wouldn't appreciate the convenience of making a purchase now and paying later? You don't have to pay anything out of pocket (at that time) to purchase any product you choose from any physical store or even online right now.

It is a blessing to those who are reluctant to pay the full price up front but have to do it because of the nature of eCommerce apps. But Tabby app recognizes this concern and permits them to purchase goods with partial or no payment.

Between 2021 and 2026, global buy now pay later (BNPL) transactions are expected to increase by nearly 450 billion US dollars.

This buy now, pay later app development is so flawless that any user can easily understand its functionality. Through this application, more than 5,000 small businesses and brands worldwide accept payments. It features well-known brands like Adidas, IKEA, and SHEIN. Let’s keep scrolling to find out about this one-of-a-kind app, its features, the costs, and the process.

What is the Tabby App?

The Tabby app, a cutting-edge payment solution, has been gaining popularity since its launch in 2020. It provides a "buy now, pay later" service, allowing customers to buy goods and services at any store that accepts them while paying users to split transactions into four interest-free installments.

This one-of-a-kind app has a massive following in Middle Eastern countries. It was founded in 2020 and now has over 3 million users in countries such as Bahrain, the United Arab Emirates, Saudi Arabia, and Kuwait.

Its simple checkout process and payment options make it a popular payment method for millions of customers. Furthermore, Tabby provides a rewards program through which users may earn points for each purchase they make. Later on, they can use the points to get discounts on future orders.

How Do BNPL apps like Tabby make money?

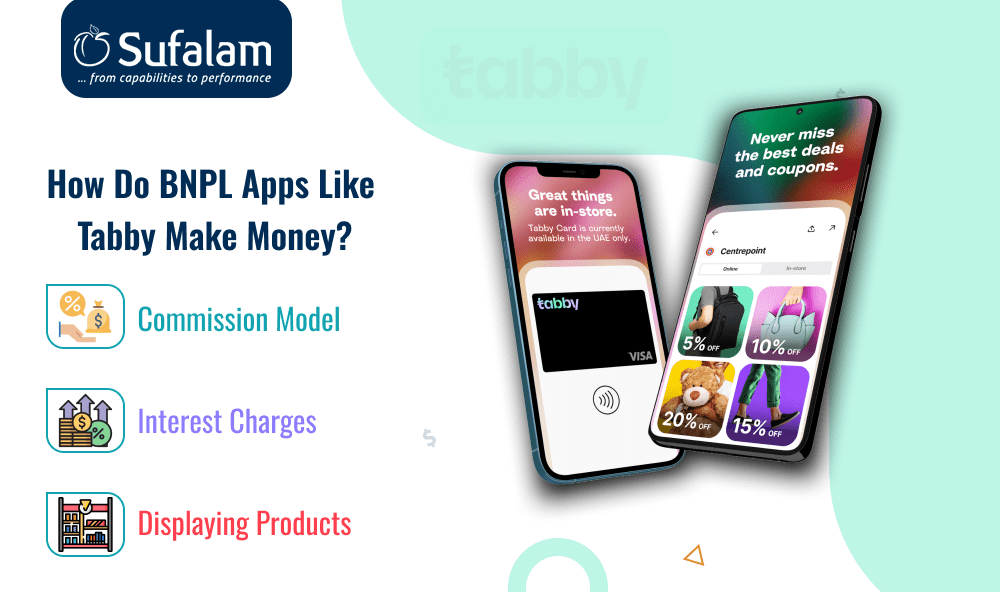

Many people think that simply knowing about the buy now pay later app development is sufficient, but the real challenge is figuring out how to make money on these platforms. There are numerous ways to make money with these apps, some of which we have listed below:

- Commission Model: Getting a commission from each purchase a user makes is the best way to make money with an app like Tabby. It may vary from 5% to 10% or even 15% based on the product or brand.

- Interest Charges: Tabby's next profitable strategy involves charging interest to the customer for each unpaid installment. It makes it possible for them to bring in enormous amounts of money each month while also appealing users to make payments on time.

- Displaying Products: Platforms can also generate revenue by charging merchants a fee to have their products displayed. Numerous up-and-coming brands pay enormous sums of money to have their products featured on these apps.

What are the Must-have Features to Build a Buy now pay later app like Tabby?

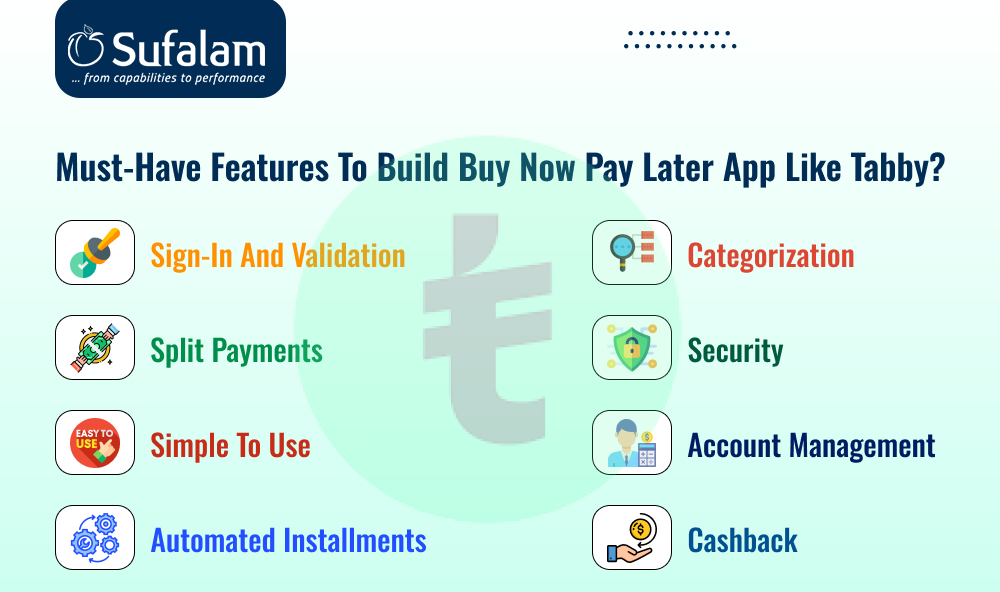

Sign-in and Validation: We'll start with the most important feature, which is login and verification. Users should be able to register using email addresses and phone numbers at the beginning of the process. It is crucial to always ask for the national identification number while maintaining security. Only then ought the verification process to be finished.

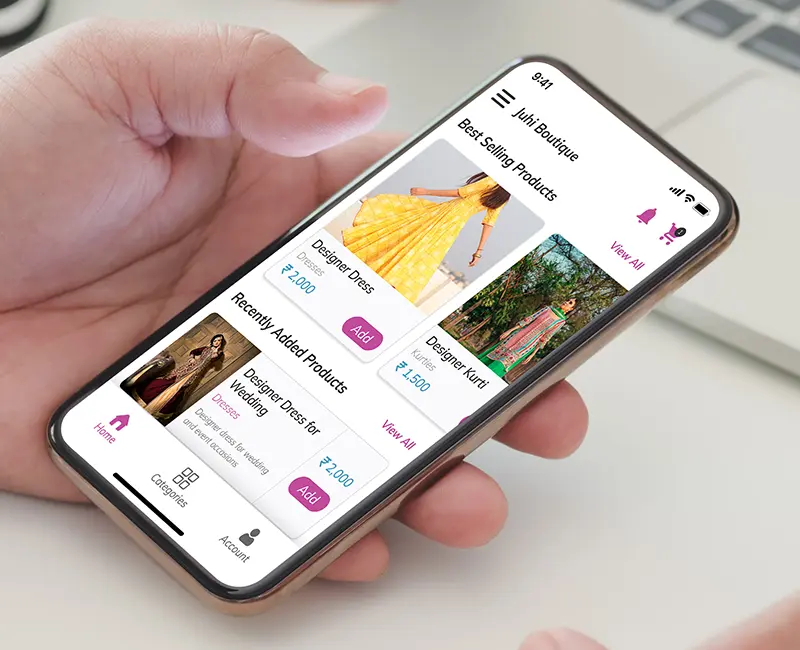

Split Payments: The Tabby app's number of installments is a unique feature that serves as the foundation for the Pay Later app. After making a purchase, customers can enter their card details to allow the Tabby app to initiate the four split payments option once per month. At the time of purchase, users are required to pay the first installment amount.

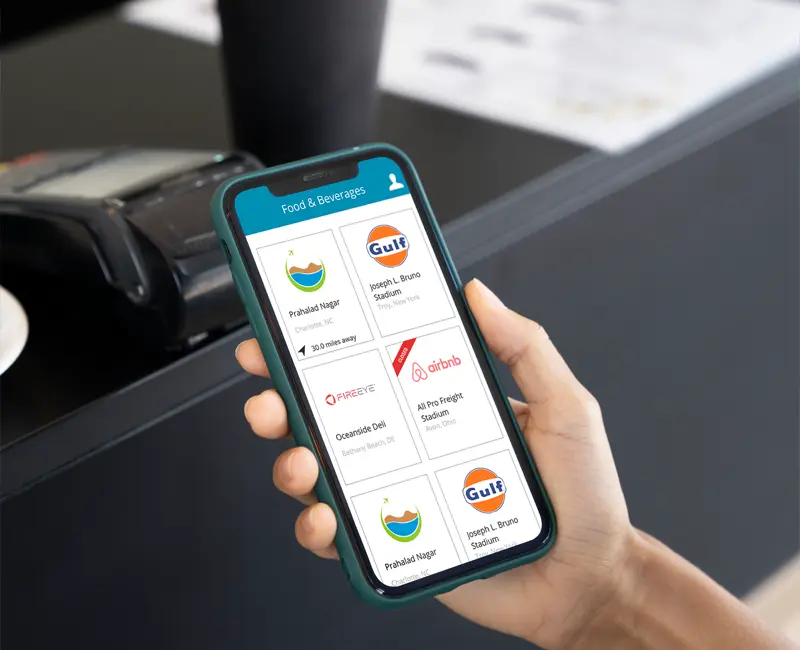

Simple To Use: Tabby's app home page makes it simple to access popular brands and deals with just one click, making online shopping hassle-free. In order to enable users to select their favorite brands and make seamless purchases, you must provide a comparable experience when creating BNPL apps.

Automated Installments: The next thing that buy now pay later apps ought to do is automatically take money out of the user's bank account or credit card for installments - because users tend to forget it. It is advised, nevertheless, to inform the clients prior to taking the installment out. Keep in mind that automatic deductions may result in returns or cancellations.

Categorization: As you create a Buy now, Pay Later app, remember to include the categories—Tabby is the top FinTech app in the Middle East. It enables customers to purchase a wide range of goods from thousands of listed businesses, including gifts & gadgets, fashion, beauty care, toys, baby necessities, home essentials, and much more.

Security: Every app should include a key security feature. It will defend your app from malware and online threats. If you want to make your app popular, you must use double authentication, which will make customers feel safer while transacting on your app.

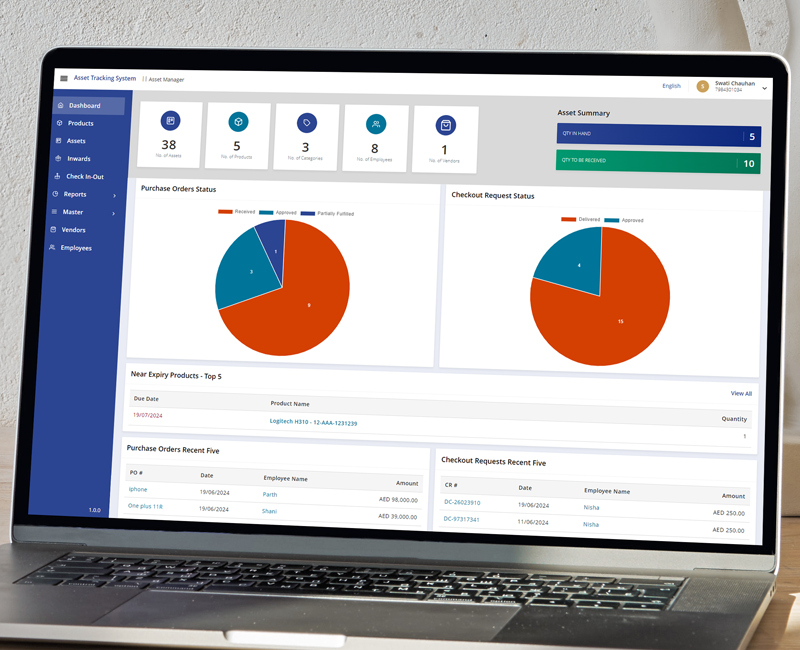

Account Management: Account management allows users to manage their account information, such as shipping addresses, payment methods, and order history. This feature allows businesses to offer personalized promotions and recommendations to their customers.

Cashback: Cashback is a further benefit that can make an e-commerce app like Tabby more appealing to customers. Businesses are able to give customers cashback on their purchases thanks to this feature. It can help to increase customer loyalty and retention.

How Much Does it Cost to Build an App Like Tabby?

The cost to build a buy now pay later varies on different factors. The company you choose will also affect how much does Tabby app costs. The size and features of the app are among the many variables that affect the cost of developing a fintech app.

If you choose a medium level of complexity, an Android or iOS mobile app similar to Tabby will cost between $10000 and $16000. A full-featured or comprehensive app is slightly more expensive, with a development project costing around $25,000.

If you want to add any additional features, such as location tracking and in-app chatting, the cost will increase. Before beginning the development process, it should be discussed how much it will cost the mobile app development company.

Different factors affecting the cost of BNPL application:

Hosting: The hosting has a significant impact on the development cost of the Buy Now Pay Later app. It is advised to pick a reputable platform that fits your budget and produces excellent results. However, it comes at an additional cost that you should consider.

Design: The way an app is designed has a significant impact on the development budget. It is essential to accurately estimate cost. When we keep things simple, the price might be lower, but it goes up with high-end designs.

App Development: If you want to purchase a Pay Later app, you have two options. You can either make it unique to your store or develop an SDK or API around it to facilitate integration with other online retailers.

Depending on the business plan, frontend, backend, and all feature development of a shop now pay later app is developed along with the integration of cutting edge technologies like virtual reality (VR) for product trials and artificial intelligence (AI) for predictive analytics. The price of developing an app will be based on all of these features and functionalities.

Development Team: The location and size of the development team that works on the app's creation are two important factors that influence the total cost. Two significant variables that are typically taken into account are the size of the team and the nation. For instance, when you hire developers from India, they will charge less than American developers.

Choice of development platform: Another factor influencing the cost to develop an mobile app is the choice of the platform the app is built on. The cost of developing an Android app is cheaper than developing an iOS or cross-platform app. However, cross-platform apps are more popular.

Developing a cross-platform application for iOS and Android will affect the final cost of application development. You need to make a decision based on your target market preferences.

To Conclude

Developing a Buy Now Pay Later app like Tabby can be a rewarding endeavor, but it is critical to understand the intricacies of these types of apps, as well as all of the costs associated with them. We hope that our guide to BNPL app development and its associated costs has been helpful to you in your project.

Since smartphones became digital devices, online shopping has grown in popularity. Sales through e-commerce have surpassed $5,2 trillion in recent years. They'll keep getting bigger. Thus, now is the ideal moment to take advantage of this expanding market and establish a presence in the Middle East.

As we have stated, comprehensive insights are important, but comprehensive insights along with the implementation will go a long way.

So, if you want to get started and are looking for the right development partner, then reach out to Sufalam Technologies. We are a leading mobile app development company Saudi Arabia and can help you navigate this emerging landscape. We are confident, based on the statistics, that BNPL will help E-commerce reach new heights.

Frequently Asked Questions

Can BNPL apps be customized?

You can customize the buy now pay later app development to meet specific business requirements if you have the right team. The modules, features, and functionality of these applications can vary depending on the requirements and preferences of the recipient.

How Long Does It Take to Create an App Like Tabby?

The complexity, features, and team productivity all affect how long it takes to build a buy now pay later app like Tabby. A basic version can last anywhere from two to four months, while a feature-rich app can last up to a year.