The days of crunching numbers with a pencil, paper, and a cumbersome calculator are long gone. Anyone can create customized recommendations for their clients using financial planning software, ranging from individual users to advisors at large firms.

Good financial planning software solutions can mean the difference between success and failure for a business. Technology is an essential component of any modern enterprise. Combining the two ideas, "Fintech app development" has shown to be a very useful tool for companies across many different industries, helping them become more forward-thinking and proficient with their finances.

According to Allied Market Research, the global financial planning software market is expected to grow at a compound annual growth rate (CAGR) of 16.6% from its $3.7 billion valuation in 2021 to $16.9 billion by 2031.

If you are looking to leverage this growing market and would like to know about the ins and outs of financial planning software development, then this blog is all you need.

What is Financial Planning Software?

It is a type of computer program that enables individuals, businesses, and financial advisors to effectively manage their finances. Usually, it includes a number of features and tools that let users monitor, assess, and make the most out of their financial assets.

Financial planning software solutions can also assist users in automating routine financial tasks, such as bill payments and investment transactions. In addition to saving users time, this lowers the possibility of mistakes when handling funds by hand.

The software can also be used for an array of purposes, and the data it handles can originate from a range of sources, including financial transactions, investment tracking, bank records, portfolio management, and many others.

To know more about how it works, its necessary features, the process for development, the cost of finance planning app development, and other things around, keep reading!

What are the different types of financial planning software development?

There are several types of financial planning software, each designed to meet specific needs and goals. Some of the most common types of financial planning software are as follows:

Personal Finance Software development

Personal financial management apps are specially made for people who wish to handle their own finances. It usually includes features like budgeting, expense monitoring, debt management, planning for retirement, and evaluation of investments.

Investment portfolio management

The investment portfolio management app is designed with the intention of assisting investors who are willing to efficiently manage their portfolios. It includes some of the crucial features such as asset allocation, risk management, portfolio analysis, and performance tracking for overseeing their investments. A few well-known platforms for managing investment portfolios are eFront, Bloomberg Terminal, and Morningstar.

Retirements planning software

Retirement planning software typically includes characteristics such as retirement income planning, expense monitoring, and evaluation of investments to help people plan for retirement.

Tax preparation apps

The tax preparation app is one of the most popular and useful financial planning applications. These assist people and companies with tax preparation and filing. This software provides users with critical tax preparation insights as well as tax preparation alerts to ensure timely payments.

Wealth Management

Wealth management software are useful for financial advisors and wealth managers who want to manage the assets of high-net-worth individuals. They usually include features like client management, portfolio analysis, financial risk administration, and financial planning.

Financial planning for businesses

The business environment, as well as the business's finances, are constantly changing. Businesses can still manage their finances with the right financial planning software for businesses. It includes features such as budgeting, forecasting, financial reporting, and cash flow management tools.

What are the must-have features in the financial planning software?

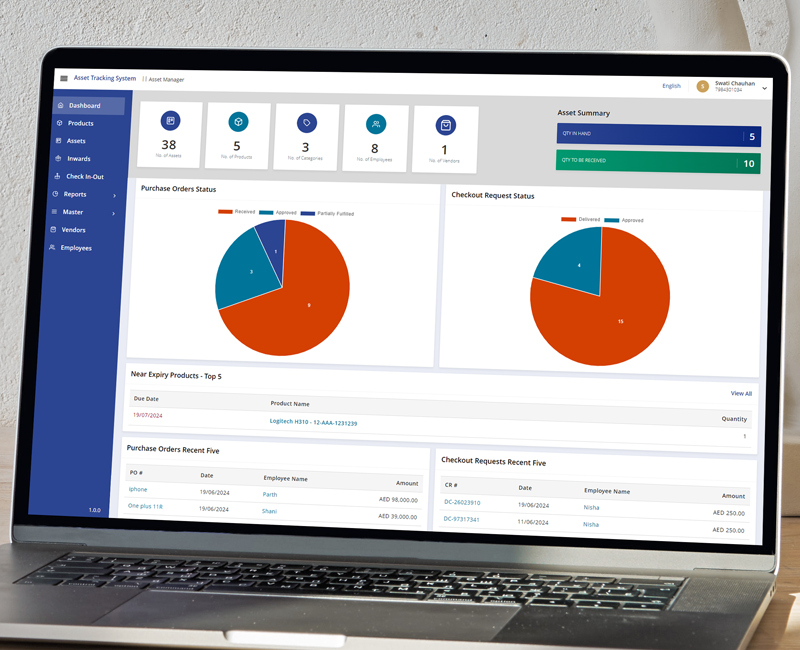

Real-time dashboard

Real-time updates on how much money you receive and spend allow you to stay on top of your finances. Through the dashboard, the application automatically updates all transactions in real time based on access to your bank accounts. It is no longer necessary for the user to manually enter them.

Link to the data on investment performance

Effective fintech app development is directly proportional to the efficiency of the investment market. The best financial planning software should include a feature that allows clients to connect their investments with the market's performance. The program will provide an accurate picture of the steps involved in achieving the ultimate investment goals.

Enhanced Analytics and Reporting

Among all the potential characteristics of financial management software, this is probably the most important. Advanced analytics tools have the power to transform your company's operations. You can keep an eye on cash flow statements, income statements, balance sheets, and financial ratios in addition to offering insightful financial analysis of your company.

Cash Flow Monitoring

Cash flow tracking will allow your users to manage their income and expenses, create spending plans, and monitor cash flow in real-time. It's a helpful tool that can give users insight into your spending patterns, point out areas where they're overspending, and take proactive steps to improve their financial situation.

Multi-Credit Handling

One of the most important features to be included in the financial planning custom software solution is multi-currency management. Without requiring manual computations and conversions, it will assist users in managing financial transactions in multiple currencies.

Forecasting & future planning

Financial planning software enables you to plan, analyze, and develop a financial strategy using a variety of financial parameters such as profit and loss, balance sheet, and cash flows. Accurate budget forecasting will help you grow your company and identify problems early on to reduce credit or investment risks.

Asset management

Your financial planning software development can also help with fixed asset management. This feature will assist you in managing the intangible assets (such as patents, trademarks, and copyrights) and tangible assets (such as furniture, vehicles, and equipment) owned by your business.

Regular audits and assessments are essential components of a comprehensive fixed asset management system, as they guarantee that all assets are properly documented and utilized.

Customizations at the core

Customization is the new standard in the software industry. Each client's basic expectations for financial planning software include the presentation of AI-based automatic suggestions and customizable reports.

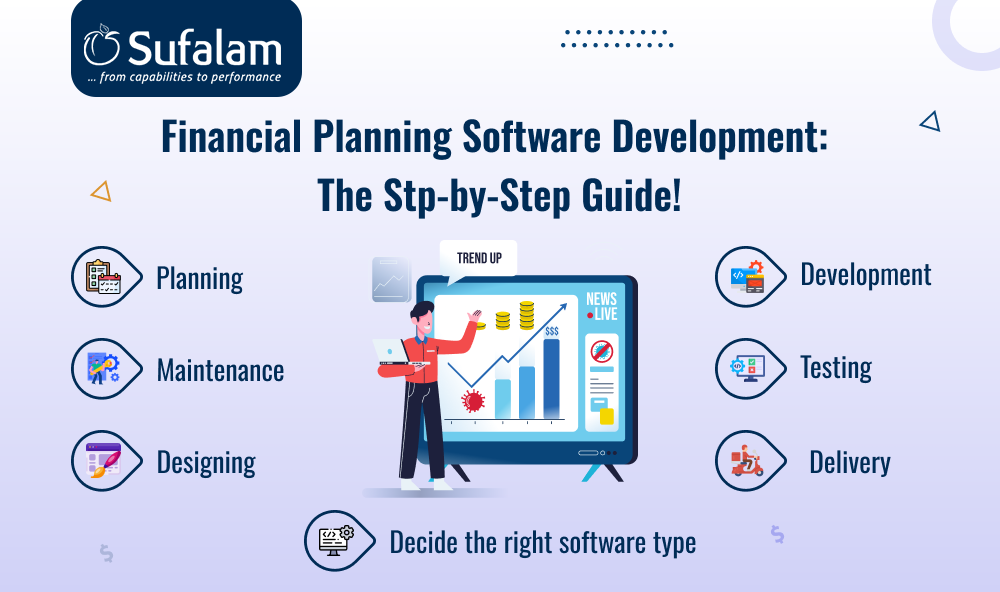

Financial Planning Software Development: The Stp-by-Step Guide!

There are multiple steps in this intricate process. Here are the main steps involved in financial planning software development.

Planning: The initial step in development is planning. Ultimately, you will specify the software's aims and purposes, pinpoint its intended user base, and list all the necessary features and functionalities.

Decide the right software type: After the planning, you must select the software type. It specifies whether you should create a goal-based finance planning app or a cash flow-based one. The goal-based financial planning software projects the goals based on the investments made.

Conversely, cash-flow-based planning software records every cent earned and provides investment guidance by projecting likely outcomes.

Designing: This includes designing wireframes and mockups for the user interface and user experience (UI/UX), as well as describing the software architecture, system elements, and database schema.

Financial planning software is supposed to create a reasonable and realistic investment output based on the user entering some basic numbers such as earnings, savings, and other investments. To ensure this, the design process should be meticulously planned.

Development: At last, the process of development starts. The app development company will code the software and this step might take several weeks or months, based on the software's complexity and scope.

All devices—desktops, mobile phones, and more—should be able to interact with the software. It's also crucial to maintain strict security parameters. The development process should be carried out with the same goal in mind from the beginning.

Testing: Testing is the fourth step. This entails testing the software to make sure it satisfies the needs and guidelines established during the planning and design phases. This may include functional testing, testing for performance, testing for usability, and security testing.

Delivery: Deployment is the fifth step. When you hire app developers, they can help you set up the software on the client's server or cloud infrastructure, configure it to meet their specific requirements, and make sure it works properly.

Maintenance: Maintenance is the final step. It's all about offering ongoing support, resolving bugs and issues, modifying the software to keep up with industry requirements and standards, and incorporating fresh capabilities and features as needed.

To Conclude

Financial planning apps are truly game-changers in this digital age. Financial planning software development is showing an increasing trend of growth in the business.

Why?

More and More Individuals are looking forward to automating and organizing their money. Organizations on the other hand, also need best-in-class full-fledged financial planning software to manage their business finances, taxes, assets, etc. If you are looking to enter this industry and capitalize on the trend, this is the best time to capitalize on the opportunities.

Nonetheless, creating such solutions is a difficult process that calls for specific training and experience in fields like data analysis, software development, and financial management.

However, in order to get the best solutions, you can collaborate with an experienced development company with a track record of delivering high-quality custom software solutions.

If you are looking for the best mobile app development in Saudi Arabia, then reach out to Sufalam Technologies. We have a team of dedicated professionals, who can understand your needs an market preferences to ensure the best results.

Frequently Asked Questions

What key components of financial planning software ought one to search for?

With financial planning software development, you can easily enter data and generate comprehensive analytical reports that could help you offer your customers financial planning solutions.

Therefore, it needs to have qualities like:

Tax-conscious tax arrangement

Financial flow management and budgeting

Organizing retirement benefits

Collaborative reporting with ongoing planning that includes suggestions and opportunities

What is the cost of developing a mobile app for financial planning?

The complexity of the program and the particular needs of the project can have a significant impact on the cost of developing financial planning software. The cost of developing custom financial planning software can range from $3000 to $10000. Depending on the software type, this amount may be greater or less.